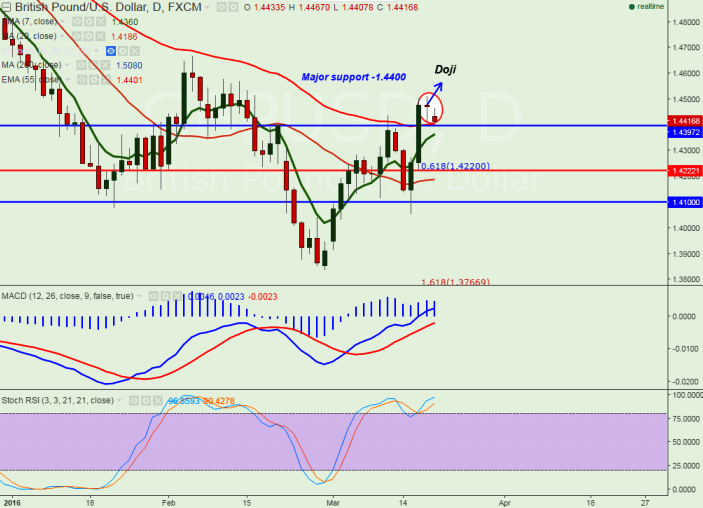

- Candle Stick pattern: Doji

- Major support – 1.4400

- Major trend reversal level- 1.4520

- The pair has made a high of 1.45145 and started to decline from that level. It is currently trading at 1.44160.

- GBP has started to decline in the Asian session on renewed ‘Brexit’ concern as Iain Duncan Smith Secretary of State for Work and Pensions resigned on Friday.

- The senior minister Iain Duncan Smith resigned after Chancellor George Osborne announced proposed cuts to disability benefits. This is a big loss to David Cameron and potentially throws a big spanner into his party's unity.

- Any break below 1.4400 will drag the pair down till 1.4360/1.4280 level.

- On the higher side minor resistance is around 1.4461 and break above targets 1.4520/1.4580 level.

It is good to sell on rallies around 1.4430-35 with SL around 1.4500 for the TP of 1.4280