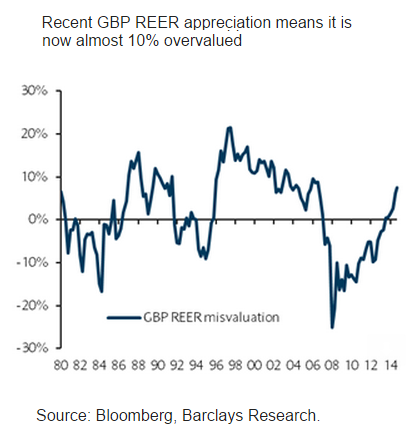

GBP was a notable G10 under-performer last week after the BoE's "Super Thursday" saw the MPC indicate a high degree of uncertainty regarding the economic outlook and appropriate timing of rate rises, encouraging the cautious GBP view of gradual out-performance against the EUR but material depreciation against the USD. This more cautious approach was most obviously reflected by the fact that just one MPC member (Ian McCafferty) voted for a rate hike, versus the 2-3 expected by the market. The MPC is likely becoming uncomfortable with the persistent sterling strength (GBP is almost 10% overvalued on a REER basis), and with the Bank Rate close to the effective lower bound, a much weaker currency has likely become necessary for the Bank to achieve its inflation target.

Furthermore, the relatively dovish BoE tone sits in stark contrast to the Fed's recent adjustment of the text of its July statement to highlight the strength of incoming US data. With a September rate hike less than 50% priced, a continuation of this dynamic should support further divergence in UK-US interest rates and additional GBPUSD depreciation toward the year-end forecast of 1.45. The recent sharp increase in the GBPUSD option skew to historically high levels makes options a cheap way to position for GBPUSD downside. Indeed, GBPUSD three-month 25-delta risk-reversals, normalized by three-month implied volatility, suggest that GBPUSD puts are approaching their deepest discount versus calls based on data since 2010.

This week, UK labour market data (released Wednesday) should reveal that June unemployment remained at 5.6% (Wednesday; consensus: 5.6%) as job creation continued to slow. Average weekly earnings growth is likely to slow to 2.9% y/y from 3.2% on lower bonus pay (consensus: 2.8%), while core earnings should pick up slightly, to 2.9% after 2.8% in May (consensus: 2.8%).

"In line with weakening employment surveys, we forecast that the claimant count for July will increase slightly, by 3.0k (consensus: 2.0k)," says Barclays.

GBP: Uncertain outlook to keep Sterling under pressure

Sunday, August 9, 2015 8:30 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX