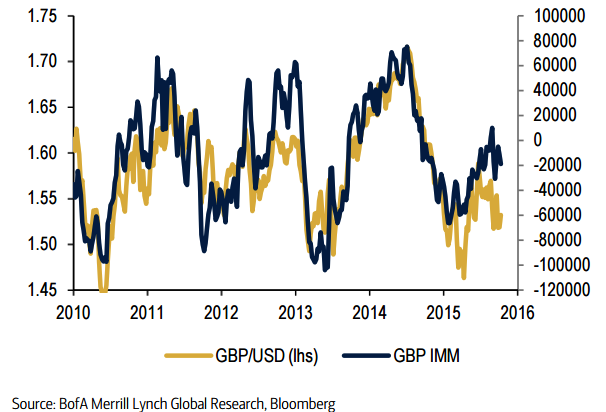

With strong momentum having waned, assessment on the prospects for GBP for the rest of the year starts with positioning. The latest IMM positioning shows a modest short GBP position held by the speculative community, but the key point here is that the strong upward momentum in GBP was driven by the unwinding of GBP shorts rather than the building of GBP longs.

Using the difference between net EUR and GBP positioning as a proxy for EUR/GBP positioning highlights the policy divergence position that was built up through 2H14 has been largely unwound.

"The proxy would suggest that while the speculative community is still short EUR/GBP it is not on the scale of 1Q15. Our own proprietary indicators suggest both hedge funds and real money have broadly neutral exposure to GBP", says Bank of America.

The recent risk-off inspired selling of GBP appears to have been driven by real money accounts that had scaled back record net long positions builtup during the summer.

GBP broadly neutral

Thursday, October 15, 2015 6:44 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed