German factory orders will attract particular scrutiny and are expected to rise by 1.0% MoM following -2.6% and -0.9% prints in January and February respectively. French industrial output is also anticipated to have edged up by 0.1% following a flat reading in February.

Meanwhile, after narrowing sharply since the middle of last year the French trade balance is expected to remain relatively stable with a -€3.6 bln shortfall. The euro area final composite PMI came in at 53.9 in April, up from a preliminary reading of 53.5. The single currency was boosted as German 10-Year bund yields rose to their highest level this year, narrowing the gap with their U.S. counterparts. The euro was also boosted after data showed that euro zone private sector activity remained solid in April, indicating that the recovery in the region is gaining traction.

On the other hand, the dollar remained under pressure after the latest U.S. trade data indicated that the economy may have contracted in the first quarter. The U.S. dollar index, which measures the greenback's strength against a trade-weighted basket of six major currencies, was down 0.30% to 94.97, not far from the two-month low of 94.47 set last Thursday. Investors were looking ahead to the ADP report on private sector jobs growth.

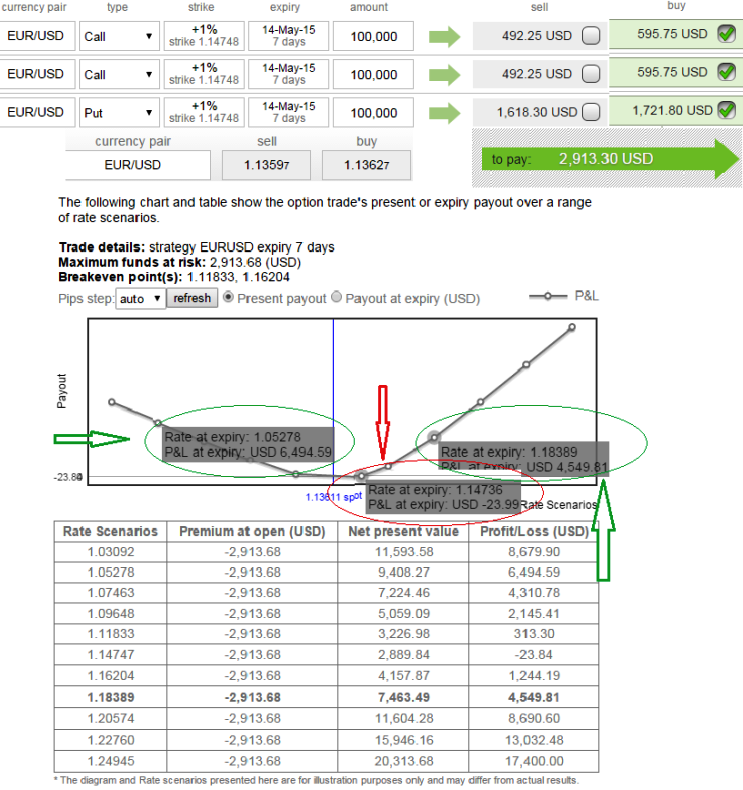

Strategies Derivatives combinations:

Trade and Hedge with Straps position in EUR/USD currency cross:

In order to construct this option strategy, the portfolio should consist of long positions of two calls and one put of the same strike price.

Typically, this would be three legs combination with long two calls and one put on the same strike and expiry. The prediction of the investor here would be more increase in underlying currency, however, the gamble in this case is the rise in underlying asset is more likely than a dip.

Maximum return = UnlimitedProfit Achieved When Price of Underlying currency exchange rate > Strike Price of Calls/Puts + (Net Premium Paid/2)

OR Price of Underlying currency exchange rate < Strike Price of Calls/Puts - Net Premium Paid

Profit = 2 x (Price of Underlying - Strike Price of Calls) - Net Premium Paid OR Strike Price of Puts - Price of Underlying - Net Premium Paid

Maximum loss = Net Premium Paid + Commissions Paid

Maximum loss takes place when the price of underlying currency = Strike Price of Calls/Puts

German and French striking data to prop up further growth in Euro

Thursday, May 7, 2015 8:27 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?