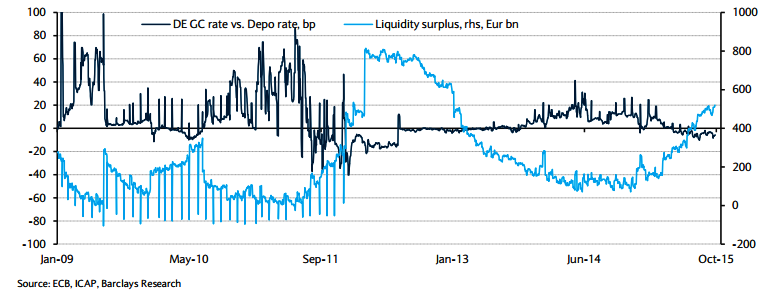

The early repayment of 3yr ECB liquidity starting in January 2013 caused liquidity conditions to tighten and spreads to widen again, but the recent increase in the surplus following the settlement of the first four TLTROs and the QE purchases has fuelled richening pressure on the German GC that moved again below the depo rate.

The evolution of the liquidity surplus since the beginning of 2009 and the German GC rate spread versus the depo rate is shown in the chart. The spread widened (meaning German GC rate trading close to the refi rate) in 2011 when the surplus was close to zero.

The spread tightened (German GC richened versus depo rate) following the big liquidity injection after settlement of the two 3y LTROs in December 2011 and March 2012.

"As the surplus is expected to keep growing (towards more than €1trn next year) and to remain ample given the average maturity of the PSPP purchases (eight years), the German GC rates will remain below the depo facility for a long period", says Barclays.

It is important to highlight that the depo facility rate is a reference rate only for banks. The cost of liquidity management for non-bank investors is higher. Indeed, anecdotal evidence shows that institutional investors' deposits are charged more than 20bp to compensate banks for the higher costs in terms of the increase in total assets that would affect their leverage ratios.

"Therefore, for non-bank investors, depositing their liquidity against core collateral below the depo rate is still convenient compared with the cost of deposits at banks", added Barclays.

German general collateral repo rate likely to remain below the depo facility rate

Friday, October 9, 2015 5:46 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed