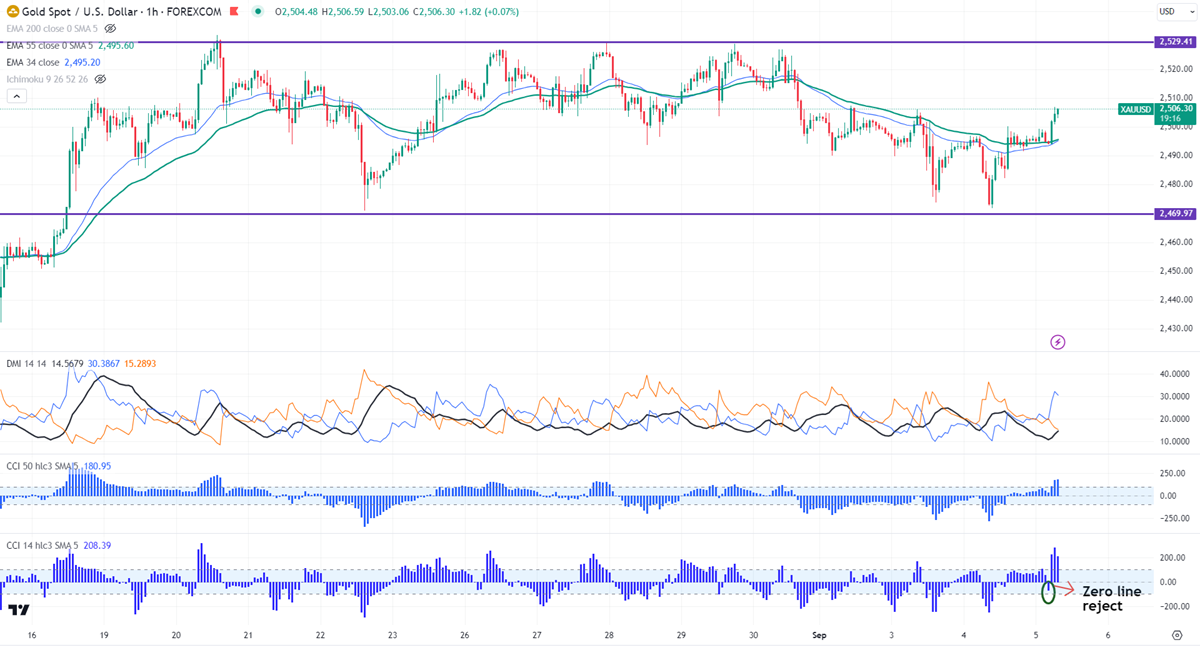

Gold recovered above $2500 after forming a double bottom around $2470.It hit a high of $2503 at the time of writing and is currently trading around $2475.

Markets eye US ADP non-farm employment and initial jobless claims data for further direction.

According to the CME Fed watch tool, the probability of a 25 bpbs rate cut in Sep decreased to 55% from 62% a week ago.

US dollar index- Bullish. Minor support around 101.20/100.50. The near-term resistance is 102/102.80.

Factors to watch for gold price action-

Global stock market- Bearish (Positive for gold)

US dollar index - Bullish (negative for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $2470, a break below the target of $2449/$2430. The yellow metal faces minor resistance around $2500 and a breach above will take it to the next level of $2509/$2525.

Indicator (1-hour chart)

CCI (14)- Bullish

CCI (50)- Bullish

Average directional movement Index - Bullish

It is good to buy on dips around $2500 with an SL around $2490 for a TP of $2520.