Gold prices rose from four-week lows as uncertainty crept back into global equity markets, while a weaker greenback also helped to spur some bidding.

- Bullion futures rose 0.71% to $1,110.00 per troy ounce after tanking within a hair's breadth of the $1,101.22 an ounce mark on Wednesday, marking the metal's lowest price since August 10.

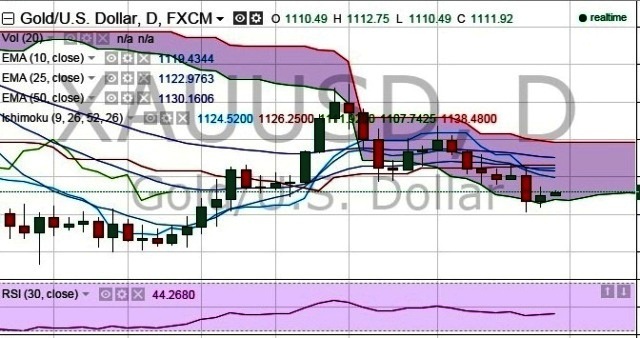

- Initial support levels are seen around $1109, $1103 and $1098 levels.

- Resistance is seen at $1121 and $1127 levels.

- We prefer to stay long on XAUUSD, Entry $ 1109/1110, Stop Loss $1101, Target $1127.