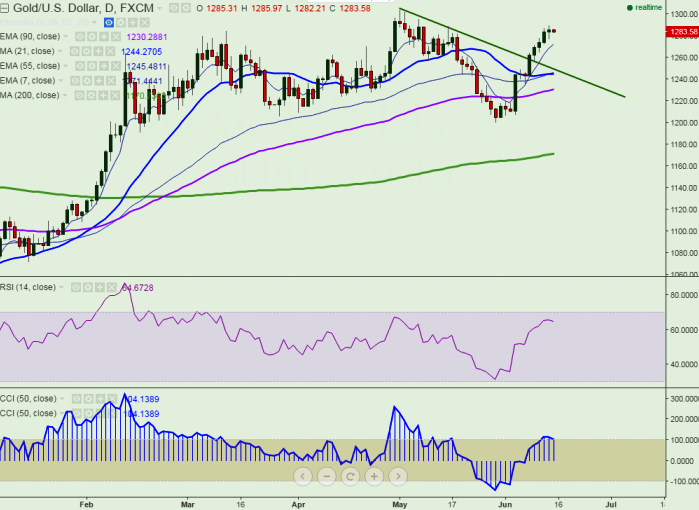

- Major support - $1267 (7 day EMA)

- Major resistance - $1289 (May 16th high)

- The yellow metal has jumped till $1289.50 yesterday and slightly declined from that level. Market awaits US Fed monetary policy meeting which will be concluded with a rate statement on Wednesday. It is currently trading at $1283.

- Markets expect the Fed to keep its interest rate unchanged in today’s meeting. The rate hike chance in Jun is very minimal at 1.9% compared to a 26.3% in May and for July is at 17.9% compared to 43.2% in May. The chance of rate hike has eased mainly due to dismal US Nonfarm Payrolls report.

- The minor support of Gold is around $1267 (7 day EMA ) and any break below will drag the pair down till $1260 (55 4H EMA)/$1248 (daily Tenken-Sen).

- On the higher side any break above $1289 will take the gold to next level at $1300/$1305.Extreme bullishness can be seen above $1305 level.

- Overall trend reversal only below $1200.

It is good to buy at dips around $1275 with SL around $1265 for the TP of $1293/1300