While the worst-case outcome may have been averted in the short run, macroeconomic conditions have deteriorated significantly during five months of unsuccessful talks. With banks having been closed for three weeks, they have reopened this week, but capital controls will most likely remain in place for a protracted period of time, undermining any recovery process.

Greek newspaper, Ekathimerini, reported recently that the Banking Transaction Approval Committee, needed for any foreign transfers, had a backlog of 2500 demands as the process is very slow and priority is being given to low value transactions because of the lack of liquidity.

At the end of Q2, the EC business climate dropped more than 10 points since its last peak in November 2014 - now standing at levels last seen in early 2013. With the exception of retail trade, which has shown some relative resilience up to now, all sub-indices have been nose diving. Annual industrial production growth (SA/WDA) fell back into negative territory in May at -0.6% y/y for the first time since October 2014. Greek Media (in particular, Ekathimerini) have reported that the imposition of capital controls have also severely affected tourism via last minute bookings (20% of annual flow). In turn, Greece's recession looks likely to worsen significantly, although the extent is difficult to gauge with any precision.

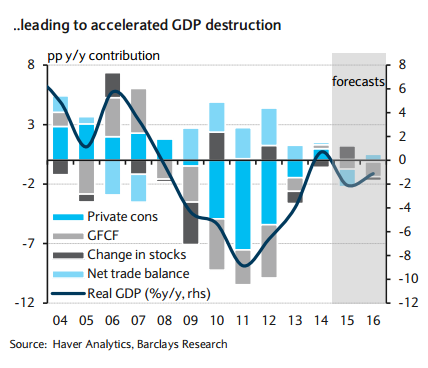

"We have revised down our GDP projections to -2.1% and -1.1% for 2015 and 2016, respectively (from -0.6/-0.1%), mostly as a result of large revisions in H2 15, with downside risks. Net exports are likely to only partially offset extreme recessionary domestic demand. At the end of 2016, we expect domestic demand to be 35% lower than at its peak in Q1 08 (private consumption: -25%; investment: -70%)," says Barclays.

The move back into deep recession is likely to have a sizeable effect on the fiscal situation of the country. From a primary surplus worth 0.4% of GDP in 2014, a primary surplus has been achieved over the first half of this year (€1.3bn for the central government, according to the central bank of Greece) only due to the under-performance of primary expenditures (down almost €3bn from the same period of last year) and additional EU structural funds (vs the 2015 budget).

Furthermore, the Greek government has started to build up arrears. Therefore, Greek public finances are likely much worse now than envisaged only a couple of months ago. Achieving a 1% of GDP primary surplus this year will likely be extremely challenging and is likely to require additional measures, which are going to be difficult to accept by Syriza MPs and by Greek citizens. Additional austerity measures would run the risk of deepening the recession even further and eventually be inefficient in improving the fiscal position of the country.

Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar

Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar  U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns

U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns  Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply

Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply  KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking

KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking  KOSPI Surges Over 12% as South Korean Stocks Rebound on Chipmaker Rally

KOSPI Surges Over 12% as South Korean Stocks Rebound on Chipmaker Rally  Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears

Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears  Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions

Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions  U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns

U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns  Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion

Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion