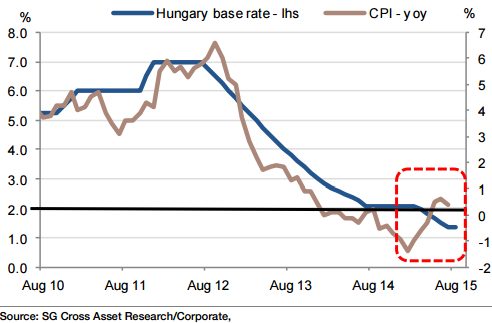

The HUF underperformed CZK, RON and PLN over the past month, partly the result of worse than forecast macro data. Q2 GDP slowed from 3.5% yoy in Q1 to 2.7% in Q2, the lowest since Q3 13. Headline CPI fell to 0.4% yoy in July from 0.6% in June, marking the first decline since January.

The NBH kept its key 2-week deposit rate steady at a record low of 1.35% on 25 August. President Matolcsy has pledged to keep interest rates steady for "a very long time".

"The central bank may tolerate more HUF weakness. Will EUR/HUF stay capped at 318, or will the rally accelerate? A short RON/HUF trade is recommended on under priced fiscal and political risks in Romania", says Societe Generale.

HUF underperforms EMEA vs EUR

Friday, September 4, 2015 12:05 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022