It can be nerve-wracking to retire, and there are a number of different reasons for this. Some people might choose to delay retirement while others don’t even plan for it at all. No matter what your fears are, it is better to take care of them in the beginning. Dealing with your fears now will prevent a headache later.

Before going into the list, it is important to point out that so many people could help alleviate their fears by creating a retirement plan. Many use simple and free online retirement calculators like Vanguard’s Nest Egg Calculator. Others use more detailed and comprehensive retirement software such as the WealthTrace Retirement Planner. And other people hire a financial planner to create their retirement plan for them.

In no particular order, here are some of the biggest fears people have about retirement.

1. Using Up All Your Money

Many people worry about outliving their money. You might worry that your savings will go away because of high expenses. This is reasonable for some people who have not saved enough. Others live above their income.

Your first step is to create a plan for retirement. You should start this before you retire so that you can easily change anything before it is too late. It can help to get a financial planner to do this. That should leave you fairly confident about your assets and income to cover your expenses. You will want to leave room for expenses that you might or might not have. You do have some options if there is not as much money as you would like, including:

-

Spending less in retirement.

-

Spending less now and saving more.

-

Get an aggressive portfolio.

-

Work some during retirement.

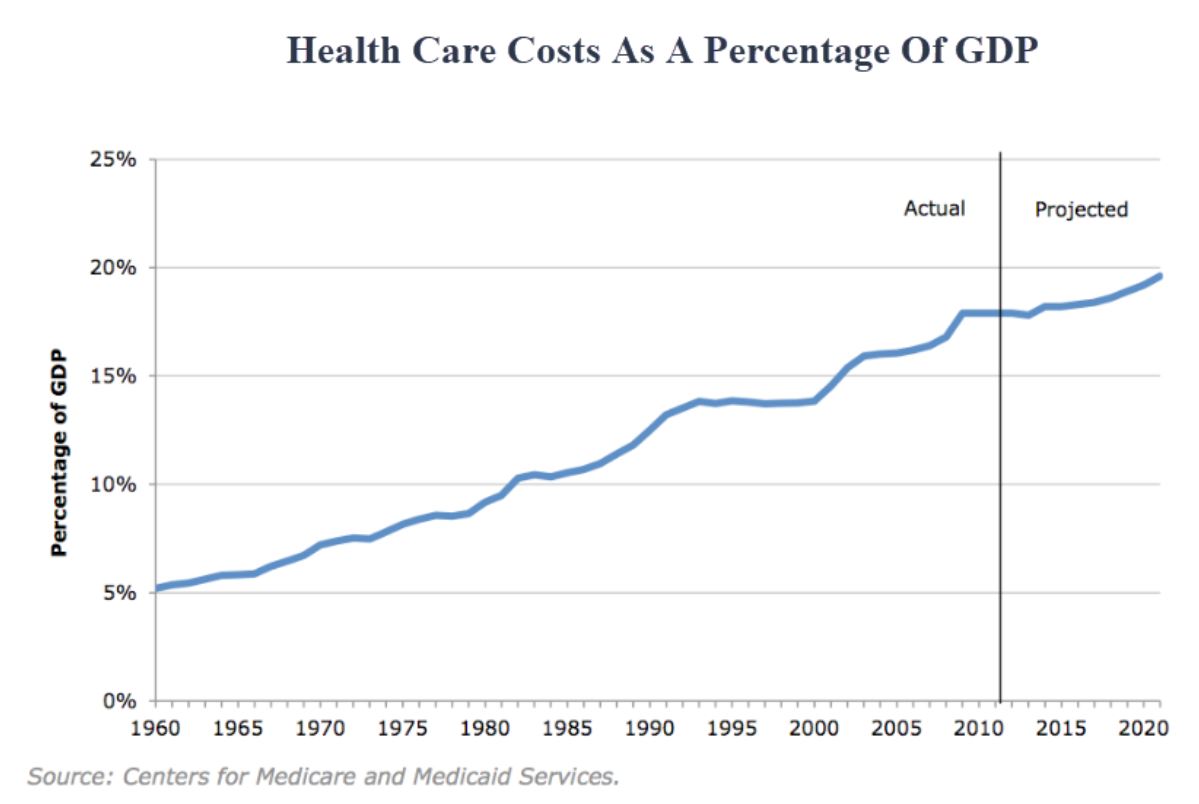

2. High Costs for Health Care

us

us

In general, your spending on health care can increase with age. You can put these in your plan, but you might have an unexpected illness. Or your expenses might be higher than average. This is where having good insurance comes into play. You can get Medicare for your basics, but you will want to get Part B quickly. That way, you can avoid a 10 percent late penalty.

3. Poor Health

Besides paying for insurance and health care, you might worry that you will not be able to enjoy your retirement because of bad health. You might not be able to travel or do other fun things. Poor well-being is a concern as you get older, but you do have some control over it.

You can always improve your habits. You should avoid unhealthy things such as smoking, drugs, and excessive alcohol. Getting plenty of sleep and living a healthy lifestyle can help you avoid failing health during your golden years.

4. Needing Long-Term Care

Only a small percentage of people require long-term care, but you never know if you might be one of those individuals. It can be hard to plan for long-term care because you do not know how long it would last for. It can even break your retirement plan.

Medicare does not cover care for the long haul except for 100 days for a nursing home. You do have some options. For example, you can consider having one of your family members care for you. You might also find a home that takes Medicaid, and there are many great places that do. One option is to start as a patient paying privately and then switch to Medicaid.

5. Caring for an Older Family Member

Many retired people care for elderly family members, such as parents. Sometimes, they also help pay for this care as well. You might spend quite a bit of your money and time doing this, so it is a good idea to prepare mentally and financially. It is a good idea to encourage older family members to have healthy habits.

You can help them do Medicaid planning now. Many caregivers, such as you, can be reimbursed for home care through Medicaid.

6. Supporting Children

You might also need to think about your children during retirement. Many parents support their adult children. While it can be generous to sacrifice to help with your adult children’s finances, it is not always the smartest thing to do. It can be a good idea to help them create a budget so that they can be self-sufficient. It is better to put a limit on what you will give them ahead of time.

7. Having a Large Expense

Many people are afraid they will have a large, unexpected expense. However, besides long-term care or health expenses, many unplanned expenses are from accidents or natural disasters.

The good news is that many large expenses can be covered by insurance. For example, a home fire or a car accident are both insurable. Making sure that these issues will be covered is something you should not neglect. It is usually affordable to get this type of insurance. Some government programs are also available.

8. Boredom

Often, men experience boredom in retirement more than women. Many people find their identity in their career, and it takes up much of their time. They do not take up other interests or hobbies. When retiring, they feel they have nothing to do.

You can prepare for this by finding interests that are not related to your job. Consider testing out a “test” retirement. Make up a trial schedule and take a staycation for about two to three weeks. By planning how you use your time, you can have a fun, yet useful retirement.

9. Mental Decline

Keeping your mind active is a great way to prevent cognitive decline. Keep learning and reading. Think of something you enjoy that can stimulate your brain. This helps you stay mentally healthy.

Face your worries about retirement now before you end your career. Even if you have already retired, it is never too late to face your concerns about your golden years and make the most of them.

This article does not necessarily reflect the opinions of the editors or management of EconoTime

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users