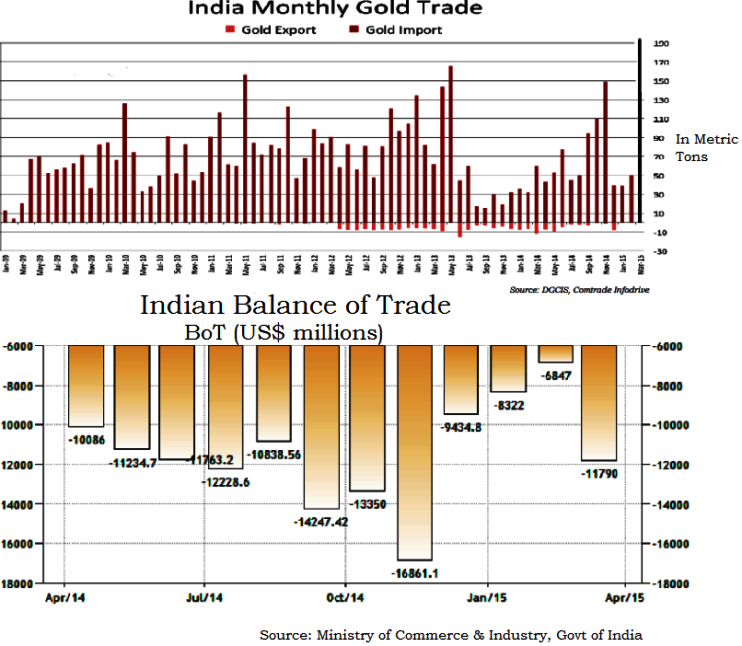

We think the Indian rupee is positioned for a little more weakness as India's gold imports surged 19.5 % to $ 34.32 billion in the 2014-15 financial year that ended 31 March, as lower prices and an easing of import restrictions prompted goldsmiths and inventories to store up the precious yellow metal.

Rising gold imports have pushed the country's trade deficit to levels around $137 billion in 2014-15. Gold imports in March have doubled to $ 4.98 billion which pushed the trade deficit to a four-month high of $11.79 billion, commerce ministry data showed.

India's gold imports stood at $28.7 billion in the previous fiscal ended 31 March 2014. However, despite rising gold imports and higher trade deficit, Reserve Bank data show that the country's current account deficit has narrowed to 1.7 % for the first nine months of fiscal 2014-15 (April-December) while CAD for April-December in fiscal 2013-14 stood at $31.1 billion or 2.3% of GDP.

We anticipate the dollar index resumes all its gains. Although deeper slump in rupee seems unlikely in the near term we still hold on to our projections for the next quarter or so which is all possibilities of rupee slipping down to 64.5 versus dollar.

Derivatives basket:

Option Strategy: Bull Call Spread (BCS)

Contemplating above mentioned fundamental factors, we recommend a Bull Spreads. One can either prefer Call or Put so as to make it Bull spread.

BCS can be established though buying ATM Call and selling another Call with a higher Strike Price which is OTM Call with the same expiration date for a net premium payable.

Use this strategy over a long call when the cost of the long call is too high and the underlying currency is expected to move fairly higher. Credit from short call reduces the cost of long call.

Increased Indian gold imports hamper premium in INR, further slump projected

Tuesday, May 5, 2015 8:10 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate