Lower oil prices apart, weak demand has meant consistently low inflation for Indian manufactured products as manufacturers do not have adequate pricing power. This is also reflected in persistently weak IIP data. Even the external environment remains challenging as exports continue to shrink. Although exports during Q2 shrank at a relatively slower pace than in Q1, the contraction in imports was much lower. As a result, the contribution from net trade is expected to be lower during Q2, says Societe Generale.

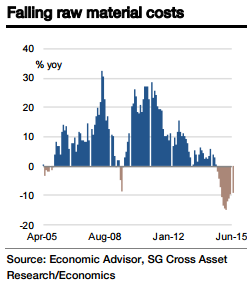

Not surprisingly, corporate performance remains weak. Despite the advantages of lower raw material costs, sales barely moved while profits tumbled. As the corporate balance sheet remains weak, a slow pick-up in corporate investment is expected. This corroborates our view that, while the economy will experience investment-led growth, the pace of recovery is likely to remain quite slow.

India's Q1FY16 GDP is expected to clock growth of 7.4% yoy, just a tad lower than the 7.5% yoy recorded in the previous quarter, estimates SocGen. Given that India's new GDP series has a very short history and is at odds with other relevant indicators, forecasting still remains a challenge.

India GDP growth to be lower in Q1 FY16 than previous quarter

Friday, August 28, 2015 6:58 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed