While global investors are optimistic over India, its consumers are not. While new government in the center pursuing policies that are beneficial to businesses are not so well for Indian consumers.

- Recently Indian government has increased import tariffs on steel to protect the domestic market and prevent flood of steel from Chinese market. While this move is definitely pro-business and good for the domestic industry, steel makers in India responded in gratitude with INR 1500/ton price increase.

- Similarly Indian government hasn't passed on the larger benefits of lower prices by raising taxes and duties, which will surely bring down India's deficit but will come at the cost of consumers.

Government of India's policies can be called as proxy to transfer household wealth to business and government account.

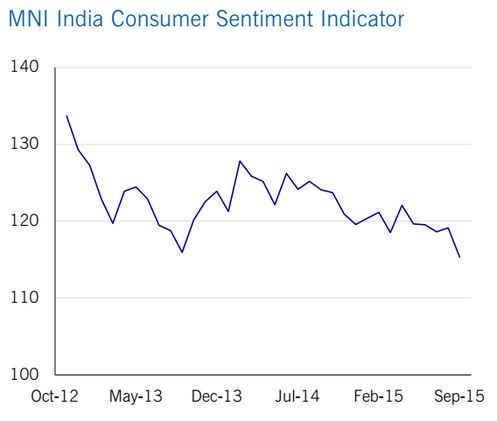

Naturally, MNI India Consumer Sentiment Indicator fell 3.2% last month to 115.3, lowest since the survey launched in November 2012.

If the government would take note, respondents were least optimistic about household finances. Its measures of current and future personal finances each fell to record lows.

However Indians are more optimist over economic developments.

India's benchmark stock index, Nifty is currently trading at 8155, up close to 5%, since Reserve bank of India introduced 50 basis points rate cut last month.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand