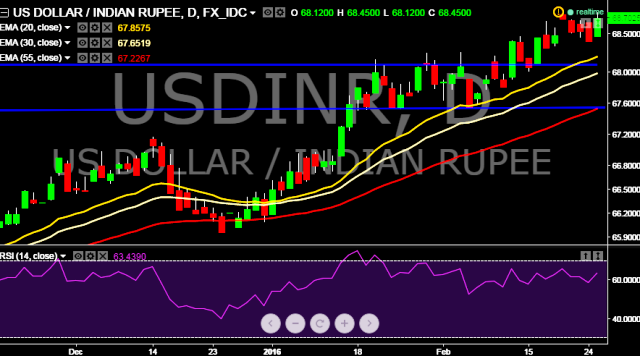

- USD/INR is currently trading at 68.7050 levels, nearer to its record low of 68.85 mark touched in August 2013.

- It made intraday high at 68.78 and low at 68.47 levels.

- Today Indian government bonds also slumped after New Delhi announced a 21 percent hike in capital spending for the railway Budget from a year ago.

- Intraday bias remains bullish till the time pair holds key support level at 68.08 levels.

- Alternatively, a daily close below 68.00 marks will take the parity towards key resistance levels at 67.62/67.50 levels.

- On the top side, key resistance levels are seen at 68.85, 69.00 and 69.22 levels.

- A key event for the Indian market will be upcoming fiscal budget, releasing on February 29, 2016.

Positioning is inconclusive at this point, with prices offering no clear cut signal to initiate a long or short trade. We will continue to remain on sidelines for the time being.