India's August IIP grew by 6.4% yoy, the highest since June 2011. The capital goods sector accounted for nearly 40% of this growth, as it grew by as much as 21.8% yoy, the highest since November 2010.

The problem is, capital goods trends tend to be highly volatile and among the major sub-sectors within the manufacturing component on IIP, it has the higheststandard deviation. In fact, had there been an across the board investment in infrastructure, that would have been reflected in some improvement in India's non-oil imports.

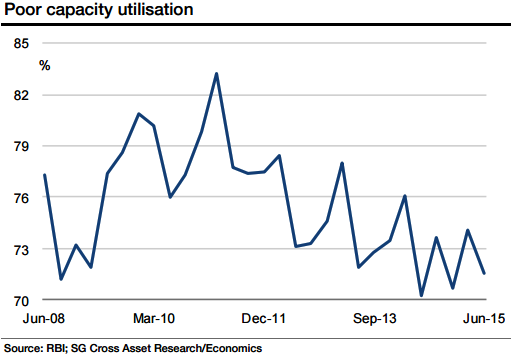

Unfortunately, however, this import component has contracted for the thirteenth straight month. Not surprisingly, capacity utilisation (as of 30 June) was at 71.5%, close to the lowest-ever utilisation rate of 70.2% recorded a year ago.

This is best reflected by the core sector's continued poor performance. The core sector is made up of eight infrastructure-related industries that are also considered leading indicators for the. economy. The core sector growth for August 2015 was a mere 2.63% yoy.

"Looking at the 12-month moving average data (to eliminate volatility), the growth rate is tantalisingly close to the lowest-ever recorded during the immediate post-crisis period and there's no sign of a bottoming-out for the time being", says Societe Generale.

India's IIP headline data masks underlying weakness

Monday, October 19, 2015 6:41 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX