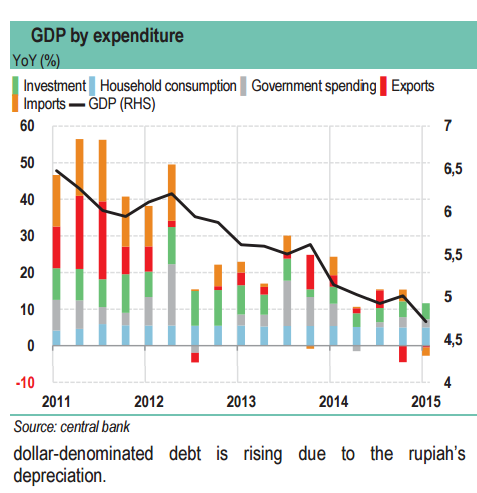

In Q1 2015, GDP growth continued to slow to only 4.7% yoy (down from 5% in Q1-2014), the slowest pace since the 2009 crisis. Household consumption remained relatively robust, but exports continued to contract for the second consecutive quarter.

The slowdown was particularly sharp in the mining industry, reflecting the decline in commodity prices, but also the contraction in production volumes following the export ban on certain unprocessed mining products since 1 January is also hurting from the economic slowdown in China, its second largest trading partner since 2009. China's share of Indonesian exports dropped from 12.4% in 2013 to 10% in 2014.

The ongoing slowdown in the Indonesian economy since 2012 can be attributed to the structure of the economy. One of its main weaknesses is its heavy dependence on commodities, even though the situation has improved over the past three years, notably due to the decline in oil production. In 2014, commodities accounted for an estimated 9% of GDP.

Commodity exports accounted for 54% of the total, and 20% of government revenues were derived from the exploitation of commodities. It is thus easy to understand why growth has slowed sharply since the drop-off in international commodity prices. As long as coal, palm oil, rubber and oil prices held at high levels, the country's economic growth exceeded 6%. Yet the World Bank now estimates its growth potential at only 5.5% if commodity prices were to hold at current levels. Even though Indonesia has become a net oil importer, the oil bill has not fallen enough to offset the impact of the decline in commodity prices on the economy as a whole.

The slowdown continues in Indonesia

Tuesday, July 14, 2015 2:03 AM UTC

Editor's Picks

- Market Data

Most Popular

U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns

U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns  Asian Stocks Slide as Middle East Conflict and Rising Oil Prices Shake Global Markets

Asian Stocks Slide as Middle East Conflict and Rising Oil Prices Shake Global Markets  China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength

China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength  Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply

Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply  Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply  China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security

China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security  U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns

U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns  EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy

EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy  European Stocks Slide as Middle East War Fears and Rising Oil Prices Shake Markets

European Stocks Slide as Middle East War Fears and Rising Oil Prices Shake Markets  Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears

Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears