Indonesia's current account deficit has reduced the degree of freedom for policy makers to support growth. Bank Indonesia (BI) has instead had to focus on deficitfinancing through keeping interest rates high, thus slowing import growth and the domestic economy.

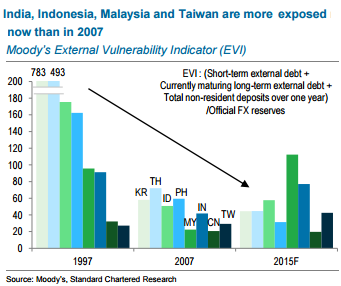

The Indonesian rupiah (IDR) to be among the most vulnerable currencies to a sudden US shock, according to Standard Chartered. Indonesia has the highest external debt-to-FX reserves ratio and the highest foreign-currency denominated external debt-to-GDP ratio

Indonesia’s external-sector risks as FOMC hikes approach

Thursday, June 11, 2015 10:58 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX