Today one of the measures for euro area inflation was published at 7.45 am GMT.

- Today's Consumer Price Index (CPI) for January came at -1.1% mom and -0.4% YoY basis. Euro did not move much, as expected since market was expecting negative numbers. But the pace of deceleration is worth noting.

- Another primary reason for the lack of movement in euro is that disinflation or deflation is expected in the Euro zone, for which the European Central Bank ECB has taken up a number of measures like introducing QE and reduction of rates in its LTRO programme.

- Nevertheless we believe this data to be of high importance considering the performance of the Euro over medium term. If inflationary pressure or expectation continues to falter over the coming months ECB will be forced to take up additional measures.

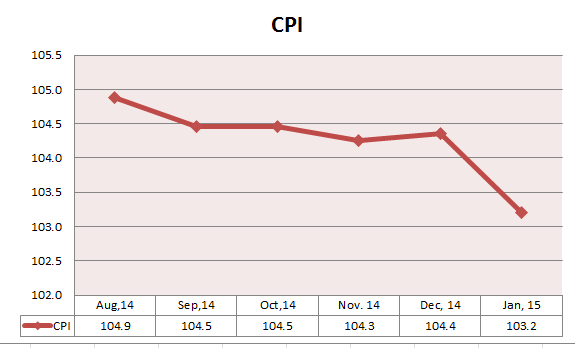

We hereby present today's report as a table and chart by taking the index base 100 on 2012, at the peak of the crisis. So far the index is well above the crisis level but seems to be faltering fast. We present data since August 2014.

This view keeps us bearish on Euro over the medium term in the awake of ECB bond purchase. Euro is currently trading at 1.141 against the dollar, up 0.17% for the day.

|

Aug,14 |

104.9 |

|

Sep,14 |

104.5 |

|

Oct,14 |

104.5 |

|

Nov. 14 |

104.3 |

|

Dec, 14 |

104.4 |

|

Jan, 15 |

103.2 |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary