Recent financial market turmoil and lower price of commodities including energy has made it tough for US central bankers to go ahead with a rate hike in immediate policy meeting scheduled for September 16th/17th.

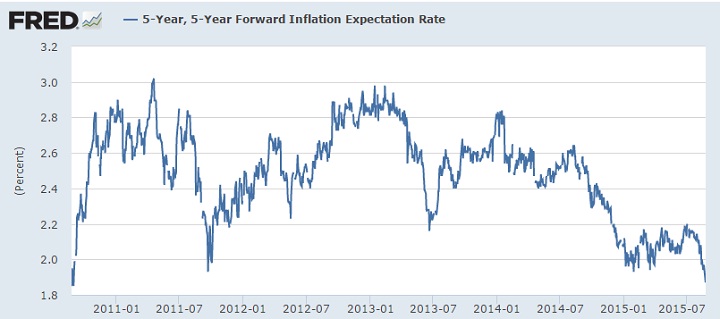

While survey based inflation expectation has remained stable, market bases measure has dropped to lowest level not seen since August 2010, when financial market was on its recovery from 2008/09 slump.

- Inflation expectations as measured by 5 year- 5 year (5y/5y) forward inflation expectation calculated using swap dropped to 1.87% as of Monday, a level not seen in 5 years.

With global energy and commodity prices at multi decade low, FED doves are going to argue strongly against a rate hike next month as lower inflation provides FED with opportunity to see further improvement in the economy as well as labor market.

Rise in global volatility has pushed investors to the safety of treasuries, which has pushed expectations of inflation down.

Sudden devaluation of Chinese currency by PBoC this month has opened up Pandora's Box of volatility and fear that China will be importing some of its deflation and volatility to the global market.

US benchmark stock index, S&P500 is still struggling to pose sustained comeback after Monday's aggressive selloff, currently trading at 1900.

China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI

China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever  Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion

Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  Trump Offers U.S. Insurance and Naval Escort for Tankers as Strait of Hormuz Crisis Disrupts Global Oil Trade

Trump Offers U.S. Insurance and Naval Escort for Tankers as Strait of Hormuz Crisis Disrupts Global Oil Trade  U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns

U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns  KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking

KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking  Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight  Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise

Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise  Dollar Gains as Middle East Conflict Boosts Safe-Haven Demand, Oil Prices and Inflation Concerns Rise

Dollar Gains as Middle East Conflict Boosts Safe-Haven Demand, Oil Prices and Inflation Concerns Rise  Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks

Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks  Oil Tanker Attacks in Gulf Escalate U.S.–Iran Conflict, Driving Energy Prices Higher

Oil Tanker Attacks in Gulf Escalate U.S.–Iran Conflict, Driving Energy Prices Higher