Intel unveiled an extensive investment strategy totaling US$100 billion spread across four states in the U.S. The tech giant aims to construct and enhance factories after acquiring US$19.5 billion in federal grants and loans. Additionally, Intel is eyeing an extra US$25 billion in tax incentives to fuel its growth.

The Vision for Columbus, Ohio

CNA reported that at the heart of Intel's five-year initiative lies the transformation of vacant lands near Columbus, Ohio. CEO Pat Gelsinger envisions this location as the future home of "the largest AI chip manufacturing facility globally," with operations anticipated to commence by 2027.

Federal Support and Market Response

Under the CHIPS Act, the U.S. government's allocation of federal funds to Intel triggered a 4% surge in its premarket trading shares. This financial backing sets the stage for Intel's rejuvenation and expansion efforts across multiple states.

Intel's strategic blueprint, as per Reuters, involves modernizing facilities in New Mexico and Oregon while expanding operations in Arizona. This move aligns with the broader industry trend as Taiwan Semiconductor Manufacturing Co. established a significant Arizona plant.

President Joe Biden's push for advanced semiconductor manufacturing within the U.S. has fueled Intel's resurgence plans. The financial provisions under Biden's initiative mark a pivotal step for Intel to enhance its market standing and operational capacities.

In 2021, Gelsinger outlined a bold strategy to reclaim Intel's top position in the industry. However, achieving profitability in this endeavor necessitates substantial government backing, a critical component for Intel's future success.

Investment Allocation and Operational Milestones

Around 30% of the US$100 billion allocation will be directed toward construction expenses, encompassing labor, infrastructure, and materials. The remaining budget will be allocated to procuring cutting-edge chipmaking tools from prominent industry suppliers.

Gelsinger anticipates the Ohio facility's operational by 2027 or 2028, depending on market conditions. Despite the meticulous planning, timeline adjustments in response to the dynamic chip market landscape remain possible.

Sustainable Growth through Strategic Investments

Intel plans to utilize existing cash flows for acquisitions, emphasizing sustainable growth. The strategic purchase of chipmaking tools from leading suppliers will bolster Intel's competitive edge and propel its trajectory toward technological advancement and market leadership.

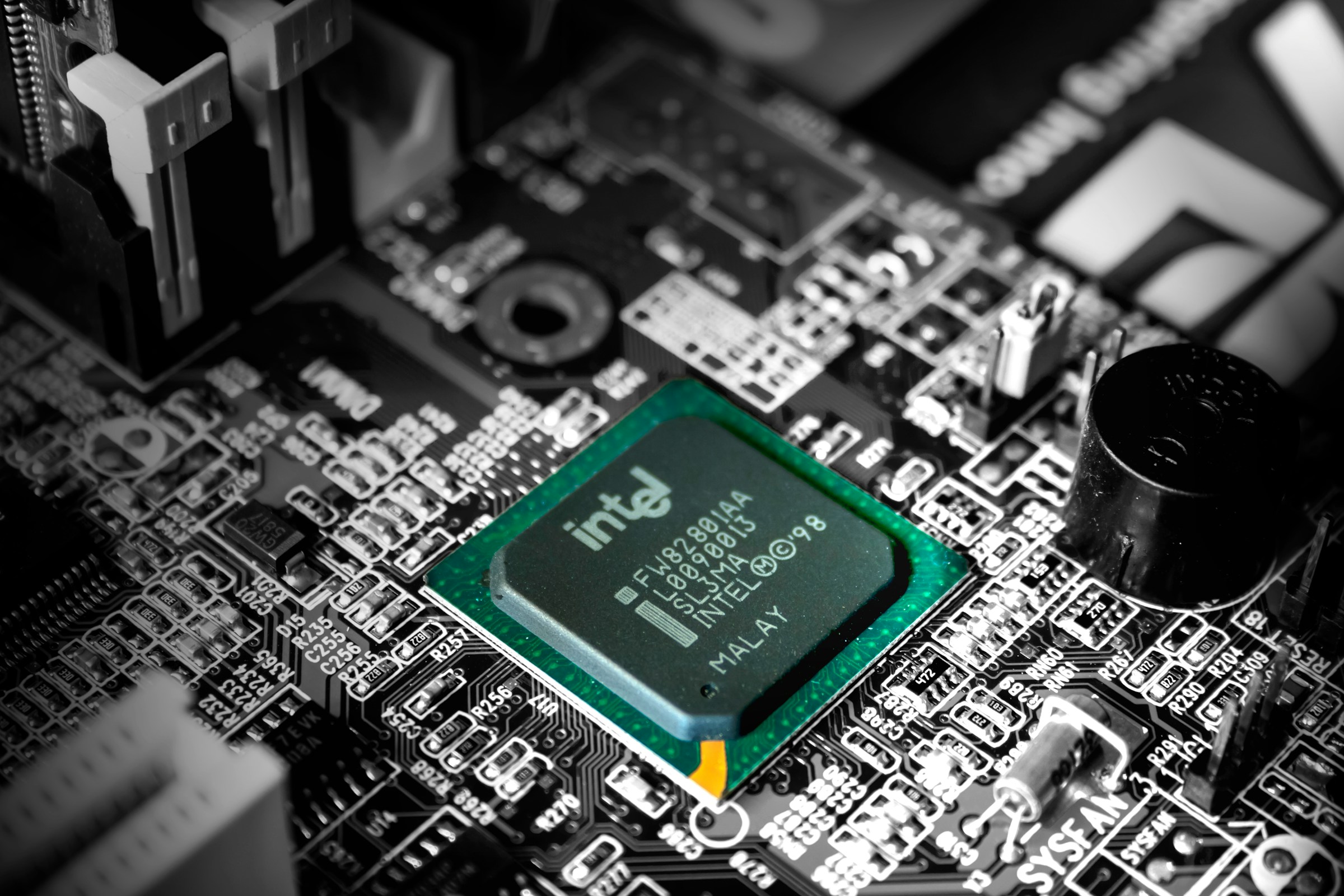

Photo: Slejven Djurakovic/Unsplash

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil