According to latest survey by Barclays, investors remain optimistic over European equities the most this year while US and emerging market equities remain out of favor.

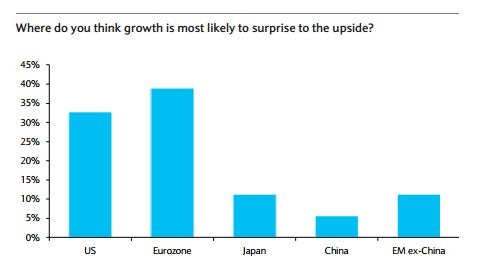

- According to survey by Barclays Inc. which surveyed almost 900 fund managers globally almost 40% of the respondents believe growth in Euro zone will surprise to the upside compared to 32% for US and approx. 10% each for Japan and emerging markets excluding China. Only 5% of the correspondents think Chinese growth will surprise to upside.

- Same survey also revealed that investors remain most bullish on Euro zone equities. Almost 55% of the investors think Euro zone equities will outperform in the next three months compared to 15% for US and Japanese equities. Only 10% of the investors believe emerging market equities will outperform.

European Central Bank's (ECB) asset purchase of € 60 billion per month is likely to spur growth in Euro zone economies.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?