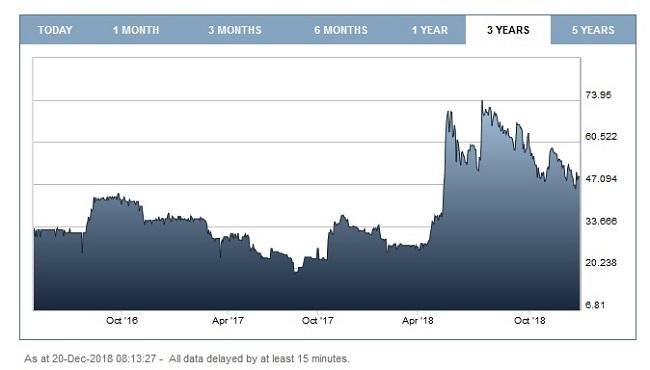

In the last one month, GAN Plc share price has seen rapid volatility, plummeting from £55 per share to a low of £45.4, before rebounding and settling at £49.5 per share.

Similarly, the 52-week range has been on a roller coaster ride, hitting an all-time high of £80.97 in July and a bottom low of £25 in February. In 2019, there is a high likelihood that the share price will break the £85 mark if the growth witnessed in the second and third quarter of 2018 is anything to go by.

According to GAN Q2 & Q3 Key Performance Indicators, there was an 11.3% growth in “Gross Operator Revenue” and a 9.7% increase in “Active Player Days” in the third quarter of 2018.

For the record, “Growth Operator Revenue” metric shows the GAN-enabled revenues delivered to clients operating their regulated gambling business and/or Simulated Gaming on the company’s technology. “Active Player Days” on the other hand refers to the average active players multiplied by the number of days in the period.

The company attributes the high growth rate in the two quarters to the launch of their second New Jersey client of regulated gaming. According to GAN CEO, Dermot Smurfit, the company will continue to invest in resources to further accelerate growth in 2019 and beyond.

In May 2017, GAN partnered with Winstar, one of the world largest casinos, to launch a Simulated Gaming™ website and mobile apps. The share price has since then taken an upward trajectory albeit with significant ups and dips. In the second half of 2018, Gan expanded their collaboration with Winstar with the launch of the Winstar real money online casino for European regulated markets.

With a price to book ratio of 2.82 compared to the industry average of 5.53, GAN share price is undervalued. The low P/B ratio coupled with the anticipated growth in 2019 makes today the best time to buy for long-term investors.

2019 is also likely to be a year of a favorable regulatory environment for the online gaming industry with analysts predicting that most U.S. states will legalise full-scale sports betting. This translates to business opportunity for GAN which will likely boost its revenues and share price both in the short and long run.

According to Smurfit, the company's potential for growth is dependent on the regulatory progress in the U.S. With some U.S. states already showing interest in legalising sport betting in 2019, we believe that this stock also presents opportunity to short-term traders.

About the Company.

GAN Plc is a tech company specialising in the development and supply of gaming software systems and online gaming content.

The company licenses its gaming systems and software to online and offline gaming operators as a turnkey solution for both simulated gaming and regulated real money.

This article does not necessarily reflect the opinions of the editors or management of EconoTimes.

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports