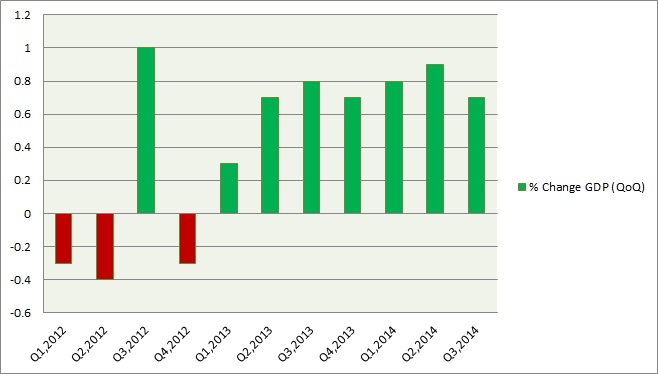

Preliminary release last month showed that Japan will be out of recession (consecutive contraction in 2 quarters) and the economy is expected to grow at 0.6%. This was slashed over the weekend release of the GDP data.

Details -

- GDP grew at 0.4% for the fourth quarter and 1.5% YoY basis down from estimate of 2.2%.

- Consumption grew at 0.5% better than previous estimate of 0.3%.

- Housing investment is down by -1.2% QoQ.

- Capital expenditure is down by -0.1%, lower than previous estimate of 0.1%.

- Government consumption increased by 0.3% QoQ, better than estimate of 0.1%.

- Inventories contributed to -0.2% contraction in the GDP number.

- Exports remained stronger than estimate at 2.8% and contributed to 0.5% in the GDP figure.

- Imports contracted by -0.3%, much lower than estimate of 1.3%

Analogy -

- In spite of positive growth and Japan coming out of recession, the growth remained weak.

- Imports may continue the slide as Yen has weakened since 2012

- Export may also continue to falter as other important economies like Euro zone have sought to competitive devaluation.

Impact -

- Bank of Japan (BOJ) may seek to further ease the monetary policy however that could be difficult as the current purchase rate at ¥ 80 trillion is quite high.

- Prime Minister Abe may refrain from further tax hike due in April and may push the tentative date further in future.

- Either the case would be beneficial for the Japanese stocks, pushing the Nikkei 225 higher. Nikkei is currently trading at 18790, down about 1% for the day. Yen is currently trading at 120.8 against the dollar, trading above the recent broken resistance of 120.5.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary