Bank of Japan (BOJ) has introduced monetary easing under the name Qualitative and Quantitative Easing (QQE) in end of 2012. That resulted in massive depreciation of Yen, leading to higher energy prices and improved Consumer price index (CPI). BOJ increased the pace of easing in October 2014 to current ¥ 80 trillion/annum.

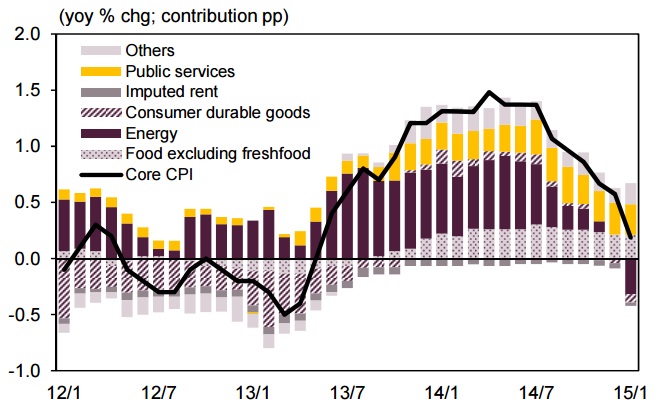

- From early 2013, core CPI increased to 1.5% by mid of 2014 from a negative territory. This provided some relief for BOJ in claiming partial victory that the strategy is working fine.

- However, Since June 2014 oil prices dropped more than 50%. Prime Minister Shinzo Abe introduced higher sales tax that pushed the economy to a technical recession by end of 2014. CPI continued to fall over the period.

- Path of the CPI and its composition is explained in the chart. As of now core CPI is hovering close to zero percent. Public services, foods excluding the fresh ones are still above the zero bound whereas energy, consumer durables and imputed rents are in negative territory. Chart courtesy sober look.

Analogy -

- Recent comments from Mr. Honda, adviser to PM Abe and BOJ member Mr. Ishida suggest that BOJ is at its wits end and may act as toothless tiger even if CPI falls to negative territory over the coming months.

- Depreciation of Yen should have covered for oil price fall, so drop in energy inflation is also due to lack of demand.

- With other central banks, like ECB, Risk bank joining the easing spree has spoiled the negative impact of Yen. Yen this year has appreciated 10% against Euro.

Yen is currently trading at 119.6, within range of 119.3-122. Yen is unlikely to gain its own direction, will be taking cues from broad based dollar strength.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?