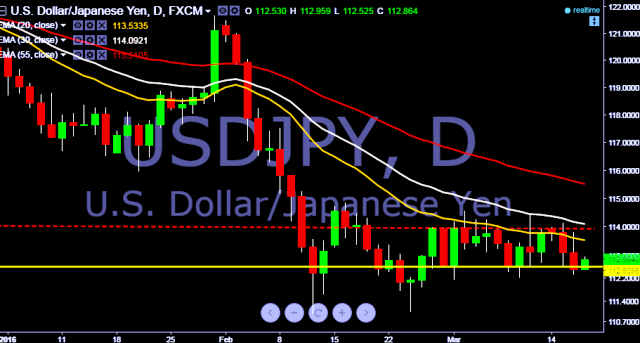

- USD/JPY is currently trading around 112.90 levels.

- It made intraday high at 112.93 and low at 112.52 marks.

- Japan’s adjusted trade balance for February came in at a surplus of $170 billion, narrower than the Y240 billion expected.

- Exports fell 4.0% year-on-year, more than the 3.1% drop expected and imports slumped 14.2%, a bit less than the 15.2% expected.

- Country’s imports have fallen for thirteen months in a row now, while exports were down from the fifth consecutive month in February.

- Intraday bias remains bullish for the day.

- Pair is likely to consolidate below 114.87 levels.

- A daily close above 114.87 is required to confirm the bullish trend and above that key resistance is seen at 115.96 marks.

- On the other side, initial support level is seen at 112.60 levels. A daily close below key support level will drag the parity towards 110.98/108.75/107.51 marks thereafter.

We prefer to take long position in USD/JPY around 112.70, stop loss 112.32 and target 113.81 marks.