Bank of Japan's policy appears to be indeed working. Though inflation has failed to take off as promised, BoJ stresses that it is strengthening as a result of yen depreciation and recovery in domestic demand. Despite the predictable drop-off in consumption following last year's VAT hike, per capita income and household consumption has remained on an upward trajectory.

Japan's wage growth is expected to strengthen due to tight labour supply and demand. Labour markets are near NAIRU, and despite recent disappointment, real wages are likely to improve as a result. While a declining workforce and population are at odds with bullish domestic revenue growth, a wealthy population with relatively high per capita income growth is supporting expanding consumption, and with healthy margins.

Against this backdrop, Japanese asset prices look relatively attractive. In an equity market that already is inexpensively valued, a high dividend yield, and continued inward rotation from domestic pension funds should support continued solid gains. The JPY, too, offers an attractive outlook. Its historic undervaluation offsets continuing and likely widening policy divergence between Japan and the US. Indeed, given the yen's safe haven properties and relative cushion from valuation and wealth, the yen looks like a particularly good regional hedge on risks to Chinese growth and the CNY.

"As it becomes clearer that Japan's inflation is stabilizing in the 1-2% range, we expect that some of the JPY's "overshoot" versus the USD will begin to unwind, but that likely is a late 2016 or 2017 story as soft wage growth and disinflationary pressures from crude oil and China have delayed solidification of inflation expectations closer to the BoJ's target", notes Barclays in a research note.

Weakness in the Japanese economy and the slowdown in Asia are chipping away at the nation's business confidence. In October, additional QQE measures are likely to be implemented, as the BoJ realises that the pace of economic recovery and inflation are both slower than initially expected.

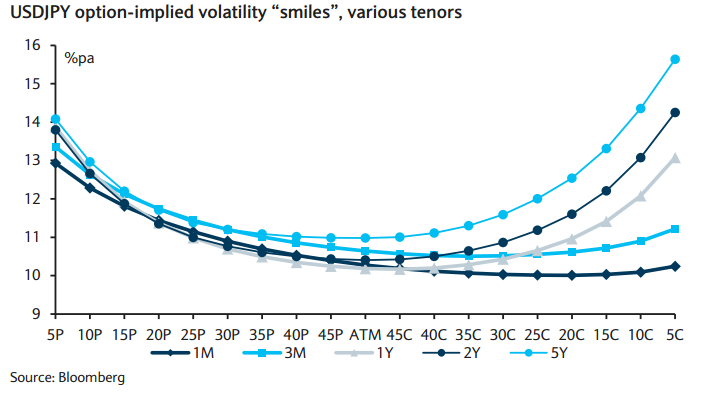

FX options' prices reveal skewed demand for USD puts/JPY calls at shorter tenors, as a hedge against "risk-off" moves. But over longer horizons, the skew most likely will be towards a much stronger yen. Given the Japanese currency's historic undervaluation and the reliability of PPP over three- to five-year horizons, a much weaker yen is extremely unlikely without an enormous policy error by the BoJ. This suggests that low-delta USD call/JPY put calendar spreads may offer rewarding opportunities.

"Risks likely are much more symmetric over shorter horizons, given the likelihood that the BoJ may ease policy further within the next year, potentially lending upside risks to USDJPY", says Barclays.

Demand for the safe haven JPY has receded after better than expected China PMI data on Thursday. USD/JPY spiked above the 120.0 handle and was trading at 120.07 at 1020 GMT. Tokyo's Nikkei average also closed higher, up 1.92 pct at 17,722.42 points.

Japanese yen and asset prices look relatively attractive

Thursday, October 1, 2015 11:18 AM UTC

Editor's Picks

- Market Data

Most Popular

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target

Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target