Korea's seasonally adjusted unemployment rate rose to 3.9% in February (January: 3.4%; December: 3.5%), in line with our forecast (3.7%) but higher than consensus (3.4%).

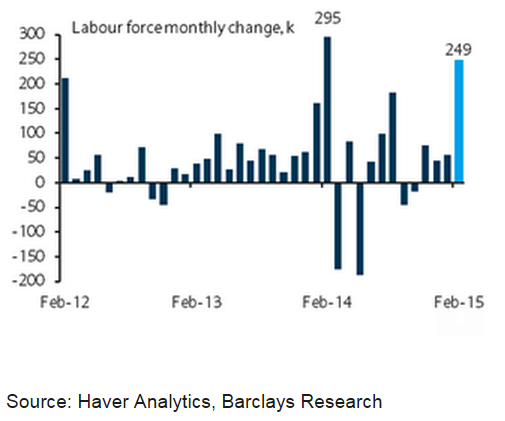

On a seasonally adjusted basis, the rise in unemployment rate was caused by an unusually large 249k (2014 monthly average: 46k) increase in the labour force.

The labour market was unable to fully absorb the surge in job seekers due to graduation season. This was exacerbated by the timing of the Lunar New Year holidays, which were celebrated in late February and meant that many of the school leavers decided to take up new job offers only in March - resulting in a large increase in the unemployment rate.

Looking past this distortion, the employment picture looks healthy. Nonfarm private sector jobs rose 158k, the largest increase since October 2011 (January: 46k; December: 36k).

Also, the participation rate improved to 63.1% (January: 62.2%; February 2014: 62.9%), a sign that the government's three-year plan for economic innovation aimed at rejuvenating the hiring potential in key services industries is working.

Barclays notes its observations as follows:

- We believe the BoK will look through the jump in the unemployment rate, given that it is likely temporary, and we expect the labour market to be supported from improving IP and exports thanks to new product launches.

- The BoK delivered a surprise pre-emptive cut on 12 March, following increased government pressure to ease further. The governor also reversed his earlier stance and downplayed concerns of high household debt.

- We take this to mean that further cuts cannot be ruled out, even through the room to cut is now limited by the record low level of the rate and likelihood of Fed rate hikes in the near term.

- However, with the BoK now joining the government in an all out effort to boost growth, we have pushed back our call for normalization from September this year to Q1 16

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022