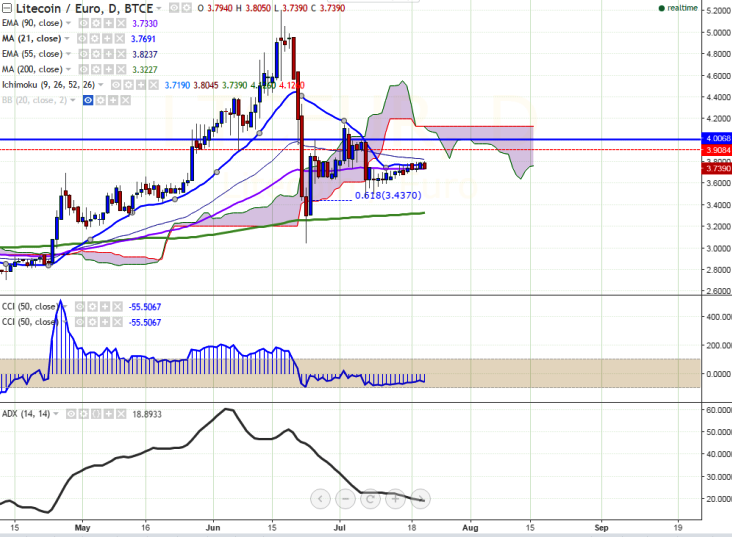

LTC/EUR is seen trading weak in red on Thursday. The pair is trading in a narrow range between 3.80 and 3.70 levels (BTCE) for the past three trading session. It is currently trading around 3.73 at the time of writing.

Ichimoku analysis of daily chart shows:

Tenkan-Sen level: 3.69

Kijun-Sen level: 3.80

Trend reversal level - (90 days MA) – 3.73

Long-term trend remains to be bullish. The short- term trend seems to be bearish. LTC/EUR is facing resistance at 55 day EMA and break above confirms minor trend reversal.

Major resistance is seen at 3.828 (55 days EMA) and any break above targets 4 (Jun 25th high)/4.145 (Jul 2nd, 2016 high). Short-term support can be noticed at 3.6995 (daily Tenkan-Sen) and any violation below will drag the pair till 3.590/3.43 (61.8% retracement of 3.04 and 4.14/3.30 (200 days MA)/3.04 (Jun 23rd low).

LTC/EUR faces resistance 55 day EMA, break above confirms minor bullishness

Thursday, July 21, 2016 12:38 PM UTC

Editor's Picks

- Market Data

Most Popular