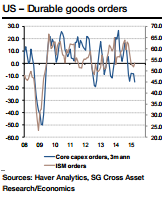

After two quarters of weakness, US durable goods orders are expected to show a bottoming in capex spending.

The manufacturing ISM rose modestly in May and the diffusion index for new orders has now posted two back-to-back increases. This is consistent with analysts' view that the capex cuts in the oil & gas sector should begin to subside and fully dissipate during the summer months.

Societe Generale projects a 0.8% m/m increase in total bookings in May and a 1.0% m/m rise in orders excluding transportation. The projections are consistent with the tentative signs of bottoming in the manufacturing sector observed in the survey data.

"The drag from the dollar is likely to be more persistent, but on balance we look for a reacceleration in equipment spending growth in the second half of the year to about 5.8%, up from a 1.7% average over the past two quarters", added Societe Generale.

KOSPI Surges Over 12% as South Korean Stocks Rebound on Chipmaker Rally

KOSPI Surges Over 12% as South Korean Stocks Rebound on Chipmaker Rally  Trump Offers U.S. Insurance and Naval Escort for Tankers as Strait of Hormuz Crisis Disrupts Global Oil Trade

Trump Offers U.S. Insurance and Naval Escort for Tankers as Strait of Hormuz Crisis Disrupts Global Oil Trade  KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking

KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking  Gold Prices Rebound in Asia as U.S.–Iran Tensions Support Safe-Haven Demand

Gold Prices Rebound in Asia as U.S.–Iran Tensions Support Safe-Haven Demand  Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty

Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty  Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply