CFTC commitment of traders report was released on Monday (18th November) and cover positions up to Tuesday (15th November). COT report is not a complete presenter of entire market positions since the future market is relatively smaller compared to Spot FX market. Nevertheless, it presents crucial picture on how key participants are looking at future moves.

Key highlights:

Market participants are net short in all currencies against the dollar, except for the Japanese yen, New Zealand dollar, and the Australian dollar.

Shorts increased:

- The Mexican peso registered the biggest increase in net short positions among its peers last week. The net-short positions increased by 12,157 contracts to -45.1K contracts.

Shorts decreased:

- The euro registered a decrease in the net short positions, the biggest among peers last week and by 10,132 contracts to -119.2K contracts.

- The British pound saw its short positions covered by 9,532 contracts to -80.3K contracts.

- The Canadian dollar registered a decrease in net short positions by 2,713 contracts to -18.6K contracts.

- The Swiss franc shorts were decreased by 1,097 contracts to -22.2K contracts.

Longs increased:

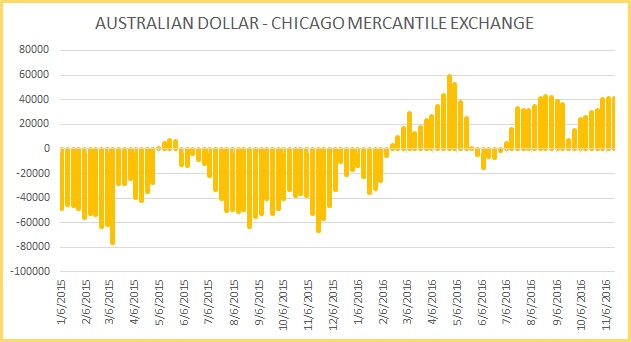

- The Australian dollar is the only counter where net longs rose and by 410 contracts to +41.5K contracts.

Longs decreased:

- The Japanese yen saw sharp decrease in the net long positions and by 11,280 contracts to +20.7K contracts.

- The net longs in the New Zealand dollar declined marginally by 462 contracts to +2K contracts.