Lido DAO- Liquid staking protocol

The Lido DAO is a Decentralized Autonomous Organization that decides on the key parameters of liquid staking protocols through the voting power of governance token (LDO) tokens. It allows users to earn staking rewards without locking assets.

DAO -

It is the logical compromise between fully centralized and decentralized, which allows the deployment of competitive products without full centralization and custody of the exchange. It works based on a smart Contract without human intervention.

Main features of Lido DAO-

- Node operators management- Select New node operators and penalize existing ones slashed by chain rules

- Governing key parameters of the liquid staking protocol.

- Payments to full-time contributors and other operational duties.

Lido DAO Liquid staking protocol involves three process

Staking- Stake any amount of your token to access daily staking rewards

Minting- Receive stETH based on the amount of ether deposited into protocol combined with staking rewards, minus penalties at a 1:1 ratio.

Yield using sETH- Use your strokes across DeFi to compound more to your daily staked rewards.

sETH- is a rebaseable ERC-20 token that represents ether staked with Lido. Seth tokens are minted upon ether deposit at a 1:1 ratio. Maker and Curve DAO allows to use of sETH.

WrappedETH(wstETH)- Wrapping stETH creates a DeFi-compatible version of the stETH token which allows for easier integrations with DeFi protocols including Uniswap and MakerDao.

It works in various other blockchains such as Ethereum, Solana,Polygon, Polkadot

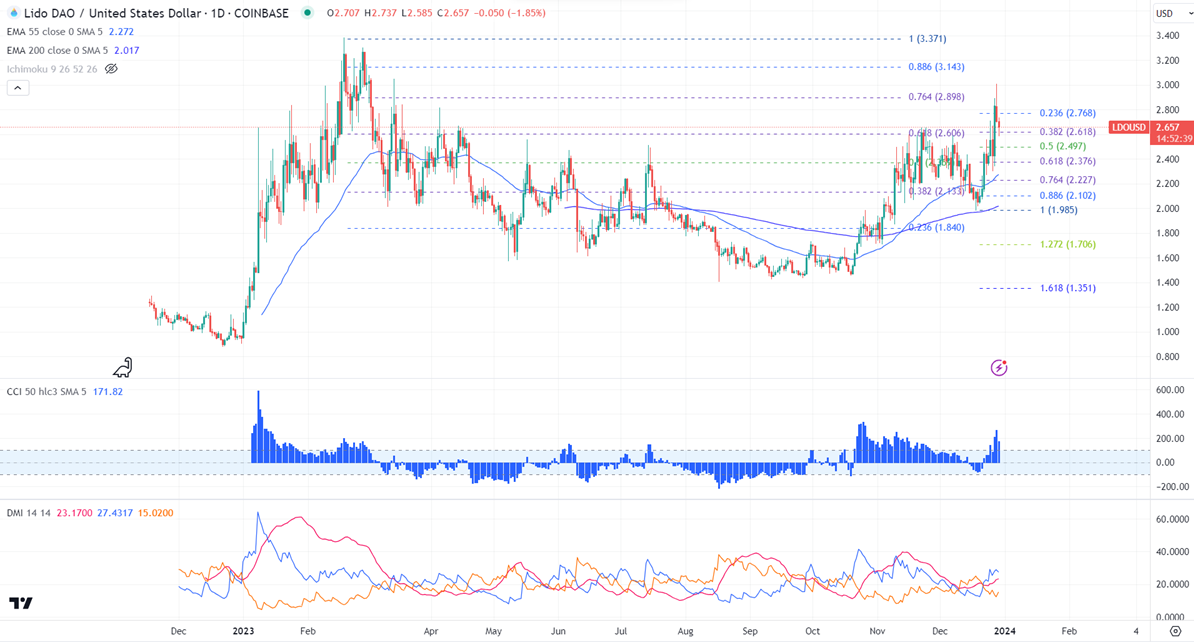

LDUSD prices jumped more than 50% from Dec's low of $1.98. It hit a high of $3 at the time of writing and is currently trading around $2.65. The pair is holding above the short-term (21 and 55-day EMA) and above the long-term moving average (200-day EMA).

The near-term resistance is around $3, any indicative breach above will take the pair to $3.40/$4. On the lower side, immediate support is $2.30, and any violation below targets $1.98/$1.40.

Indicators ( Daily chart)

CCI(50)- Bullish

Directional movement index - Bullish

It is good to buy on dips around $2 with SL around $1.40 for TP of $3.40

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary