Barclays notes:

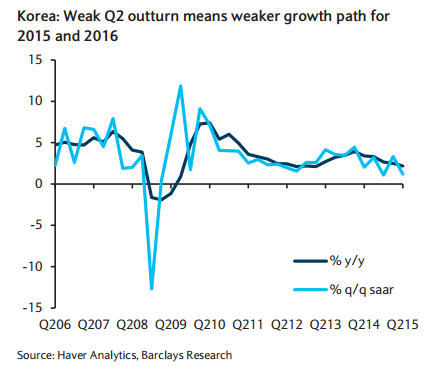

Korea's advance estimate of Q2 15 GDP showed weak growth of 0.3% q/q sa (Q1: 0.8%; Q4 14: 0.3%). On an annualised basis, growth slowed to 1.2% q/q saar (Q1: 3.3%; Q4: 1.1%), which translates into 2.2% y/y (Q1: 2.5%; Q4: 2.7%) - the slowest pace since Q1 13. The weakness was largely driven by a sharp contraction in private consumption (Q2: -0.3 q/q; Q1: 0.6% q/q), as the recent MERS outbreak dampened consumer confidence, which ultimately weighed on private spending. Meanwhile, the severe drought affected agricultural production, which registered its sharpest q/q drop since 1990. This added to the trend of continued weakness in external demand amid higher inventories, which precipitated sluggish IP and exports in Q2.

Given the weaker-than-expected Q2 outturn, we lower our GDP growth forecasts for 2015, by 40bp to 2.6% (BoK: 2.8%), and for 2016, by 30bp, to 3.7% (BoK: 3.3%). That said, we continue to expect a meaningful sequential pickup in H2, as the shock from the MERS outbreak subsides, which likely leads to a payback in consumption, as we saw after the 2003 SARS outbreak. In addition, we think the conditions for a late-summer acceleration, albeit modest, in IP and exports remain in place, helped by inventory destocking in the electronics and auto sectors, and a stronger recovery in the US and Europe.

On an expenditure basis, net exports and consumption were the main factors behind the soft Q2 print. Net exports subtracted 0.2pp from the overall q/q growth rate (Q1: -0.2pp; Q4: -0.1pp) on the back of prolonged weakness in exports. That was compounded by soft consumption, which slumped to a drag on growth in Q2 (Q2: -0.1pp; Q1: 0.3pp; Q4: 0.2pp), following three consecutive quarters of expansion. Gross fixed capital formation was the major growth contributor, though smaller than in previous quarters. While there was a welcome q/q pickup in facilities investment, its percentage contribution to growth remained essentially zero, as larger businesses continue to be hesitant to invest amid a weak growth outlook and an unfavourable tax environment.

MERS drives Korea's consumption lower in Q2 GDP

Friday, July 24, 2015 1:23 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX