Following two months of decline, Hungarian industrial production growth returned to positive in November. However, growth was capped at just 0.6 percent, in both adjusted and non-adjusted terms, data from the statistics office KSH showed on January 6.

Despite a slight improvement compared to a 2.1 percent drop in industrial output seen in the previous month, the continued poor performance of industry suggests the economy is unlikely to meet the government’s target of 2.5 percent for full-year GDP growth.

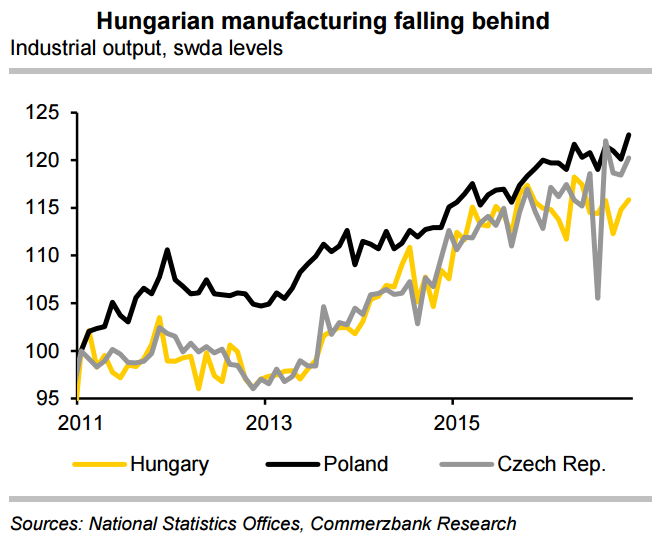

The result is disappointing in comparison with stronger recoveries across the region. Ignoring the headline year-on-year readings, manufacturing trends via seasonally-adjusted industrial output levels, show that Hungarian manufacturing has begun to distinctly lag behind Polish and Czech production.

Polish and Czech production accelerated in November driven by a pickup in German orders, whereas Hungarian output level stagnated, unable to move ahead of levels reached already in 2015. Hungarian industry has seen an erratic year, mainly due to the ill-effects of the auto sector’s struggles.

Looking ahead, although confidence in industry increased both in November and December, a sharp decline in PMI and pauses in production at the Hungarian factories of German carmaker Audi suggest industrial production in December is likely to remain subdued.

"We do not anticipate noticeable pick-up in coming months, and as a result estimate slower 1.3% growth for 2017. This is why we expect MNB's monetary stance to remain more accommodative than those of NBP or CNB. We expect EUR-HUF to move up towards 315.00 over the coming quarter." said Commerzbank in a report.

EUR/HUF was trading at 308.07 while USD/HUF was at 292.72 at 11:25 GMT. FxWirePro Currency Strength Index showed Hourly EUR strength was at 40.4645 (Neutral) and Hourly USD strength was at -40.5326 (Neutral) at 11:30 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Gold, Silver, and Platinum Rally as Precious Metals Recover from Sharp Selloff

Gold, Silver, and Platinum Rally as Precious Metals Recover from Sharp Selloff  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes

US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes  Oil Prices Steady as Markets Weigh U.S.-Iran Talks, Dollar Strength Caps Gains

Oil Prices Steady as Markets Weigh U.S.-Iran Talks, Dollar Strength Caps Gains  U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings

U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings  Taiwan Urges Stronger Trade Ties With Fellow Democracies, Rejects Economic Dependence on China

Taiwan Urges Stronger Trade Ties With Fellow Democracies, Rejects Economic Dependence on China  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding

Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding  Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade