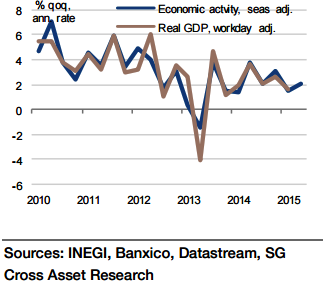

Mexico's industrial production and economic activity releases suggest that growth likely slowed to 2.0% yoy in Q2 even though activity growth improved to 2.2% yoy in June. While the supply side proxy puts Q2 growth at 2.1% qoq (annualised), the demand side growth might be slightly higher at 2.4% qoq (annualised), still significantly below previous Q2 growth projection of 3.5%.

"This adds to the downside risk on 2015 growth forecast of 2.6%. However, assuming factors causing recent growth weakness, such as low external demand from the US, reverse trend in H2 and beyond, above trend growth in 2016 is expected", says Societe Generale.

Recent weakness apart, the IP improvement since last year has been largely driven by strengthening US growth and a jump in vehicle exports. Except for the past few months, Mexico's real export growth has surged impressively on average. The improvement in the competitiveness of exports, and, therefore, stronger investment growth was achieved via lower wage growth in a weak labour market and should be helped by the weakening peso.

Stronger manufacturing and trade gains are expected in H2 15, boosting the rest of the economy via the investment, employment, wage and sentiment channels. Given the most recent US economic data releases and the surge in Mexico's manufacturing production in June, the Mexican industrial production slowdown may be temporary, although it could lead to a downgrade of our growth expectations for 2015.

"Improvement in IP growth through the remainder of this year should help the economy grow to its potential in H2 15 and then to strengthen in 2016. Currently, the Mexican economy is expected to grow by 2.6% (with considerable downside risk as discussed above) in 2015 and 3.2% in 2016", added Societe Generale.

Mexico's GDP growth likely slowed in Q2

Wednesday, August 19, 2015 4:32 AM UTC

Editor's Picks

- Market Data

Most Popular

Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply

Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply  U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector

U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector  Gold Prices Rebound in Asia as U.S.–Iran Tensions Support Safe-Haven Demand

Gold Prices Rebound in Asia as U.S.–Iran Tensions Support Safe-Haven Demand  Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise

Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise  Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty

Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty  China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI

China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI  Asian Stocks Slide as Middle East Conflict and Rising Oil Prices Shake Global Markets

Asian Stocks Slide as Middle East Conflict and Rising Oil Prices Shake Global Markets  Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements

Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements  Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume

Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume  Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility

Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility  China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength

China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength