The sources of the moderation in inflation were generally in line with the view, although the adjustment was clearly sharper than anticipated. Over the five years through 2014 regulated gasoline prices had increased around 10% per year. This trend changed in 2015, when the government committed to increase prices by no more than 3%. Persistent oil price declines, however, led to an even slower rise in gasoline prices, which look set to increase by just 2% this year. Additionally, the government announced a reduction in electricity tariffs early in the year. Together, these factors pushed down energy price inflation to multi-year lows.

Increased competition in the telecom sector spurred by reforms led to more front-loaded and persistent price reductions than expected. Outside the one-off drops in prices early in the year due to the elimination of national long distance tariffs and in November due to seasonal mobile phone tariff discounts, telecom prices have declined steadily throughout most of the year, keeping services inflation well below the central bank's target.

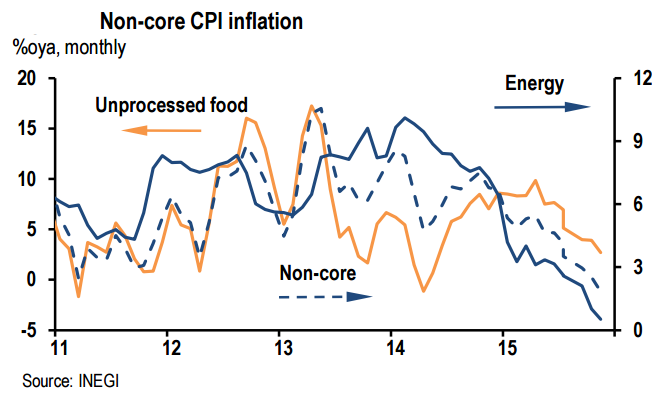

Two additional factors contributed to lower-than-expected inflation this year. Following supply-driven increases in unprocessed food prices last year, prices normalized somewhat, sharply reducing unprocessed food price inflation from a 7% average in the past five years to an estimated 2% this year. Together, declining energy and unprocessed food price inflation fueled an unexpected drop in non-core inflation to multiyear lows.

Cyclical conditions also played an important role. The economic recovery was not as vigorous as expected, keeping demand-side inflation pressures at bay, and dampening, to a certain degree, firms' ability to pass on to consumers cost increases stemming from currency depreciation. Additionally, FX hedges, accumulated inventories, and the possibility that firms initially saw the depreciation of the peso as temporary might have kept passthrough pressures at bay.

Mexico's inflation drags in 2015

Tuesday, December 22, 2015 9:59 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022