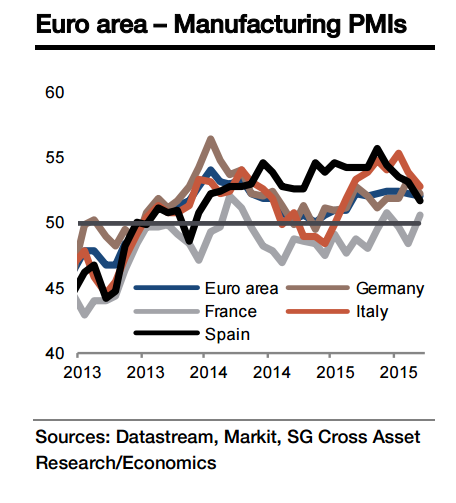

The flash PMIs released this week is expected to show a mixed picture, with positive numbers from France but considerable weakening in Germany. Despite the disappointing Bank of France survey and the forecast for the INSEE survey, there is weak momentum in the French PMIs which are starting from a low base.

"We expect the services PMI to rise to 52.3 (from 51.9) and manufacturing should also increase (51.1 from 50.6) as domestic consumption continues to be the main driver of growth", says Societe Generale.

In Germany, though, the downward path shown in the final September numbers will continue following the plunge shown in the ZEW survey last week. Services should fall (53.5 from 54.1), as well as manufacturing (51.5 from 52.3) amid weakness in global demand and the emissions scandal at Volkswagen.

In the euro area as a whole the result is likely to be a decline in the manufacturing PMI (51.8 from 52.0) but a small rise in the services figure (53.8 from 53.7). As a result, the composite PMI would be unchanged from September at 53.6, a level consistent with GDP growth at 0.4% qoq.

Mixed picture for October euro area PMIs

Monday, October 19, 2015 8:26 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022