NZDJPY gained nearly 50 pips after the BOJ monetary policy. The intraday trend is bullish as long as support at 87.40 holds. Having reached an intraday low of 87.989, it now trades around 88.48.

In a highly anticipated move, the Bank of Japan (BOJ) held its benchmark interest rate at 0.5%, therefore its sixth consecutive meeting without variation since January 2025. Coinciding with the BOJ's updated economic forecast, which kept core CPI predictions steady at 2.7%, the decision was made 7-2 vote with hawkish opposition. For FY 2025, tapering to 1.8% in FY 2026, GDP growth was slightly revised upward to 0.7%. Amid input from newly elected Prime Minister Sanae Takaichi, who supports accommodative monetary policy, Governor Kazuo Ueda confirmed a gradual tightening path dependent on economic circumstances. Policy: Along with worldwide commerce doubts, constant inflation over the BOJ's 2% goal, and reduced market expectations for a December rise highlight the cautious and. The path ahead for Japan's economy is unclear.

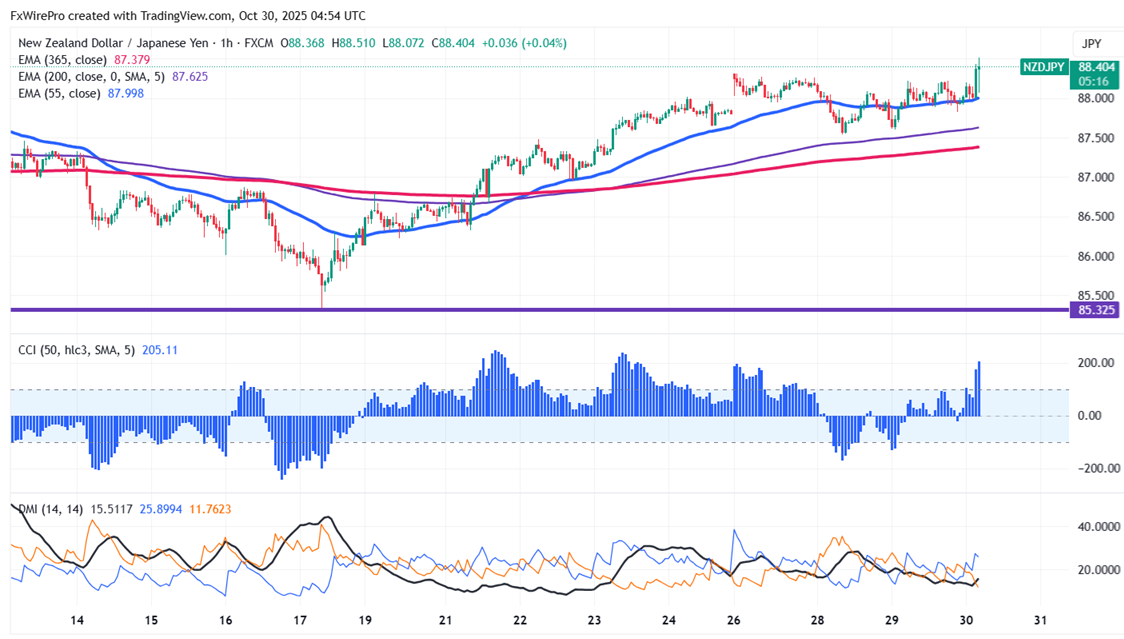

Oscillators and moving averages to forecast the trend of NZDJPY

CMP- 88.33

EMA (4-hour chart)

55-EMA- 87.98

200-EMA- 87.61

365-EMA- 87.37. The pair trades above the short and below the long-term moving average.

Major support- 87.80. Any breach below will drag the pair down to 87.40/86.95/86.40/86/85.37.

Major resistance - 88.50. Any break above 86.86 confirms minor bullishness, a jump to 89.25/90.

Indicator (4-hour chart)

CCI (50)- bullish

Average directional movement Index- Bullish. All indicators confirm a bullish trend.

It is good to buy on dips around 88 with SL around 87.40 for TP of 89.20/90.