- EIA storage report was published last night inventory fell by 198 billion cubic feet higher than market expectation of 191 billion but still lesser than previous 228 billion cubic feet.

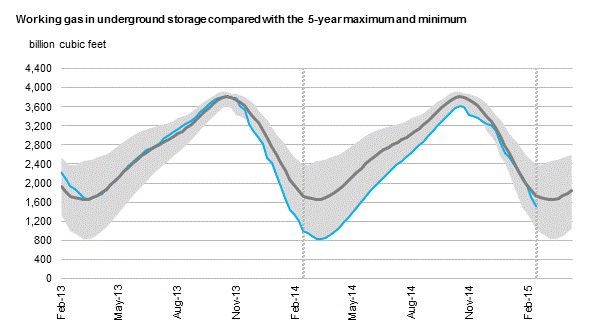

- Interesting is that working storage is 1512 billion as of march 6 2015, much below than 5 year average of 1737 billion cubic feet.

- As eastern part of US got a colder blast, storage fell by 104 billion cubic feet to 618 billion. Chart explains the changes in storage.

Price of natural gas fell overnight from $2.80/mmbtu to $ 2.68/mmbtu over the lesser than previous fall in inventory.

Nevertheless traders and investors should be cautious over the next set of data releases as natural gas dynamics change.

Why?

- Natural gas over the coming decade is expected to take over crude oil in its share in global energy consumption.

- Recent trends suggest advanced economies are coming of latest technologies in consumer appliances and motor vehicles that are more electricity driven for which natural gas is key component in generation.

- This year in US alone 4318 MW worth of electricity generation capacity would be installed when oil and coal will see reduction.

- Moreover storage may not hit bottom like last year but as it moves below 5 year average next year's buildup could be much lesser. If next year a similar weather that of 2013 occurs, then price might turnaround faster.

- Lower energy price has also prompted some producers to cut back on production.

Natural gas is currently trading at 2.68/mmbtu, down close to 2% for the day. More downside is possible in near term however it would pay off to be cautious in months ahead over the storage and production.