USD/JPY lurched up to a new 13 year high (125.87) in earlyJune, but another string of comments from MoF and BoJ officials suggesting little scope for further JPY weakness capped the move and the last couple of weeks have seen consolidation in a 122-124 range.

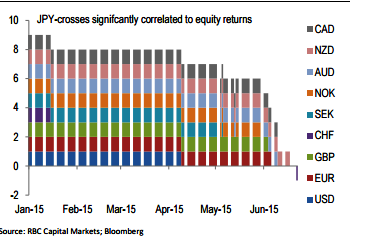

USD/JPY is expected to make more new highs in Q3 and JPY's apparent loss of safe-haven status removes another obstacle to this happening. In the latest three months there were no JPY crosses significantly correlated to equity returns except CHF/JPY and in that case, JPY is trading as the risky asset and CHF the safe haven.

This is unprecedented in the postcrisis era when typically all JPY crosses with the exception of USD/JPY have traded as proxies for general risk appetite, with JPY as the safe haven.

JPY's apparent loss of safe-haven status is such a recent phenomenon has to leave a question mark over how sustainable it is, but for now that JPY appears to benefit much less than it did in periods of risk aversion removes another obstacle to near-term USD/JPY gains.

JPY's status is changing should perhaps not be that surprising. Japan's external flows have undergone a transformation in recent months due to the reallocation of public sector assets overseas, which at the very least should be neutralising some of the flow that was at the root of JPY's safe haven status. These sustained equity outflows are also a key reason why JPY is expected to be bearish near-term, says RBC capital markets.

New JPY lows in prospect

Wednesday, July 8, 2015 6:58 AM UTC

Editor's Picks

- Market Data

Most Popular