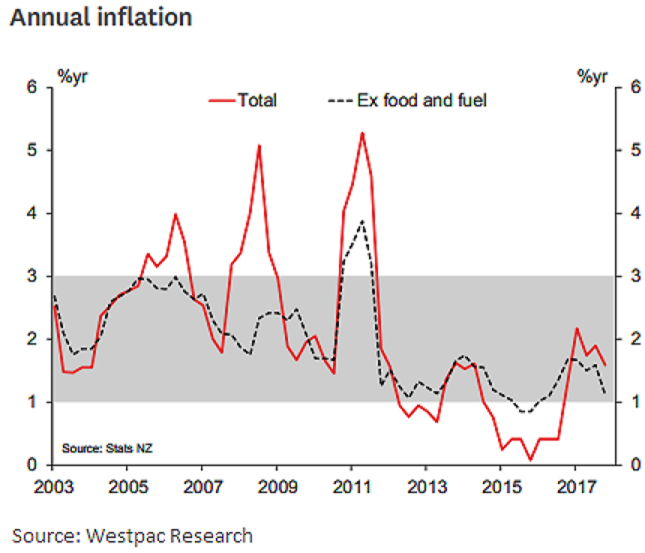

New Zealand’s consumer price inflation is expected to remain in the lower half of the Reserve Bank of New Zealand’s (RBNZ) target range over this year, implying no urgency to raise interest rates, according to a recent report from Westpac Research.

Inflation was more subdued than expected at the end of 2017, largely reflecting a lack of price pressures for internationally-traded goods. The Consumer Price Index rose by 0.1 percent in the December quarter, bringing the annual inflation rate down from 1.9 percent to 1.6 percent.

Today’s result reinforces the view that the need for OCR hikes is a long way off. Despite an improving global economy, inflation – particularly in terms of the manufactured goods that New Zealand imports – remains largely absent. Meanwhile, domestic inflation has picked up from its lows but is still well below pre-financial crisis levels.

"We expect annual inflation to remain below 2 percent over the course of 2018 as well. The economy is expected to continue growing, but at a modest pace that is unlikely to put it at risk of overheating. The global economy is improving, but the weakness of global inflation suggests that some spare capacity remains. In such an environment, it is hard to see the Reserve Bank coming under pressure to lift the OCR," the report added.

Lastly, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals