Natural gas is trading in Bullish tone especially for last three weeks. Price has challenged key resistance area around $3.03/mmbtu and traded as high as $3.11/mmbtu. Price is up almost 25% from its recent low around 2.45/mmbtu

Natural gas is likely to move higher around $3.5/mmbtu as intake is expected to be larger this year, making rate of injection to be lower than average year.

- Weather does the trick for natural gas. During harsh winter gas demand goes up due to use of heaters and this year above average temperature in US leading to high consumption through air conditioning.

Almost 32% of the production is used to generate electricity. As of now Natural gas stock stands at 1897 trillion cubic feet, 38 billion cubic feet below 5 year average.

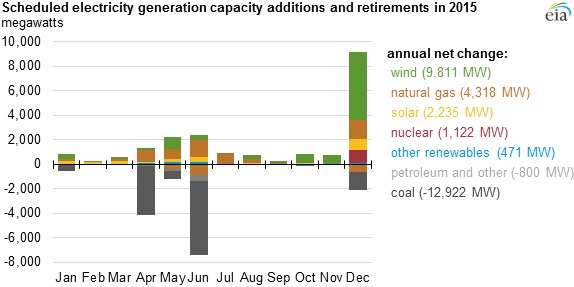

- Natural gas demand from power plants are expected to go up as they install more capacity and turbines which use natural gas as fuel. Power plants across US are installing 20 Gigawatt (GW) worth of Capacity among which almost 30% or 6.3 GW. Power plants will be scrapping 12 GW worth of capacity that runs on coal.

Increased Natural gas capacity is another reason to go bullish on Gas. Natural gas is currently trading at $2.95/mmbtu, support lies around $2.8-2.77.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate