The FOMC has indicated that it is unlikely to signal a rate hike ahead of time, instead opting for the full flexibility of a data-dependent approach.

As such, there is little scope for changes in the post-meeting statement. The economic assessment could be marginally more upbeat. However, thiswill be offset by the inflation language where the previous reference to energy prices having stabilized needs to be updated.

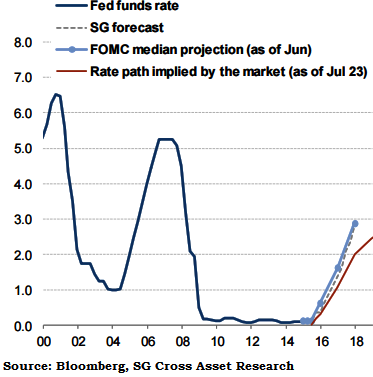

"The risk to the growth outlook is still likely to be balanced. Recent Fed speeches, particularly by Chair Yellen, suggest that the Fed has a strong desire to begin policy normalization and would like to start the process sooner rather than later", says Societe Generale.

The hurdle with respect to domestic data appears to be quite low and we believe that economic conditions will support a rate-hike decision by the September FOMC meeting. If there is a delay, it will likely be driven by international or financial developments.

Just two weeks ago, market participants believed that Greece and China would make it impossible for the Fed to hike this year. Today, this is giving way to new renewed concerns about the dollar's strength and commodity price weakness potentially delaying the Fed.

"A September hike remains as expected. Admittedly, financial conditions do have the potential of delaying the Fed. But, the dollar would have to appreciate more noticeably and energy prices would have to remain well below $50/barrel throughout the summer months. Such conditions as unlikely", added Societe Generale.

No Fed liftoff signals ahead of September

Wednesday, July 29, 2015 5:19 AM UTC

Editor's Picks

- Market Data

Most Popular