After delivering a comprehensive package of policy easing measures in August, the Bank of England is widely expected to stay pat at its September policy meeting scheduled next week. Focus is likely to be on the wording in the minutes which are released alongside the decision.

August minutes noted that 'If the incoming data proved broadly consistent with the August Inflation Report forecast, a majority of members expected to support a further cut in Bank Rate to its effective lower bound at one of the MPC’s forthcoming meetings during the course of the year.' And any change in the wordings could provide clues to gauge how likely it is that the Bank will loosen monetary policy further at the November meeting or beyond.

To a large extent incoming data have been broadly consistent with the Bank’s latest forecasts. Bank of England Governor Mark Carney on Wednesday defended the central bank's decision to launch stimulus efforts in the wake of the Brexit vote. "I absolutely feel comfortable in the decision that I supported and the committee took in August to supply monetary policy stimulus," he told members of the Treasury Select Committee in London.

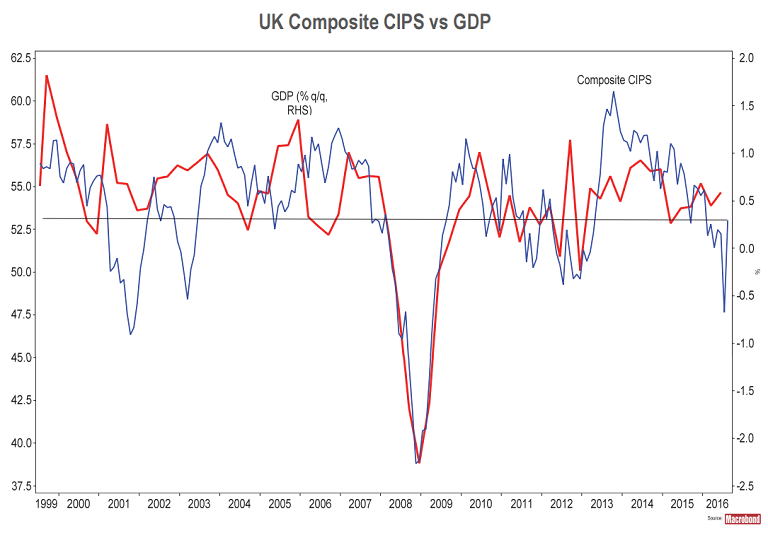

A recent round of U.K. economic data have come in stronger than anticipated. Carney also said the risk of recession for the British economy has been reduced compared with before the June 23 referendum in which the majority of U.K. voters showed support for the country leaving the European Union. Bank’s GDP projection had assumed that the PMI surveys would bounce back. After nose-diving in what was a shock in the aftermath of the Brexit vote, PMI surveys have more than recovered those losses in August. Outcome of Q3 GDP which will be released on 27 October will be crucial.

Bank of England's survey showed earlier on Friday that the proportion of British people who think the Bank of England will raise interest rates over the next year has plunged to record low. The report showed 21 percent of people surveyed in August expected the central bank to raise rates in the next 12 months, down from 41 percent in May, the lowest level since the survey began in 1999. Nineteen percent of respondents thought the BoE would cut rates in the coming year, up from just 5 percent in May and the highest level since November 2008.

Cable higher on the day after upbeat UK data releases. GBP/USD hovering around 1.33 handle, while EUR/GBP at 0.8461 at around 12:00 GMT.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength