If one asks, how costly is oil, there could be many an answer to that. While the simplest one would be to say the prevailing price, which is currently $51.3 per barrel (WTI). However, that hardly tells you whether it is cheap or costly. Then one can refer to history. The price of oil would seem quite cheap given the fact that despite its remarkable close to 90 percent rally from the bottom this year, the price is still down more than 50 percent from its $106 per barrel price in the summer of 2014. But, that same oil price would look costly when compared to $25 per barrel, prevailing in 2003.

So, a different set of measure is required when comparing the historical oil price and for that purpose, gold seems to be a very suitable instrument to measure the price level, since it has a very long history of barter. In addition to that, gold is considered as one of the most effective hedges against inflation. Hence measuring oil price against gold could give us some insight on the costliness of oil price.

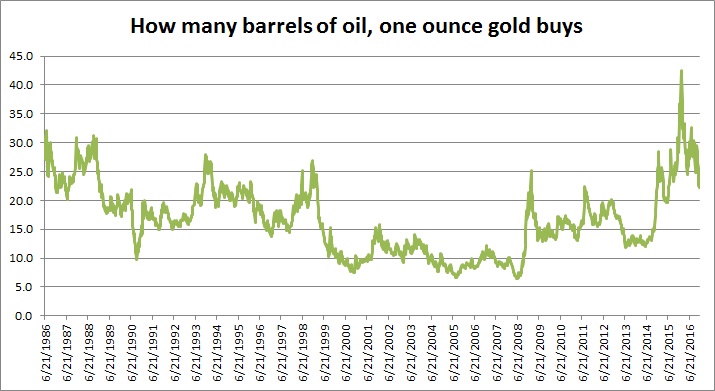

Looking at the data over last three decades, an ounce of gold on an average has bought 16.6 barrels of oil. In 2008, when the oil price reached an all-time high above $140 per barrel, an ounce of gold bought the fewest about 6.3 barrels of oil. And earlier this year in January, the same gold bought more than 42 barrels of oil. As of now, an ounce of gold buys a little more than 22 barrels of oil.

So historically speaking, the oil price is still quite cheap but it is closing in on its long-term average.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX