In terms of percentage gains, 2016 was a very good year for oil (WTI). It jumped from just $32 per barrel in January to $53.7 per barrel to end the year. That is more than 67 percent gains. However, 2017 has so far been nowhere near. With the first quarter and few days gone, oil price is down more than 5 percent YTD. However, that is not bad considering the risk the oil market faces from the liquidation of speculative positions. Here’s the elaboration,

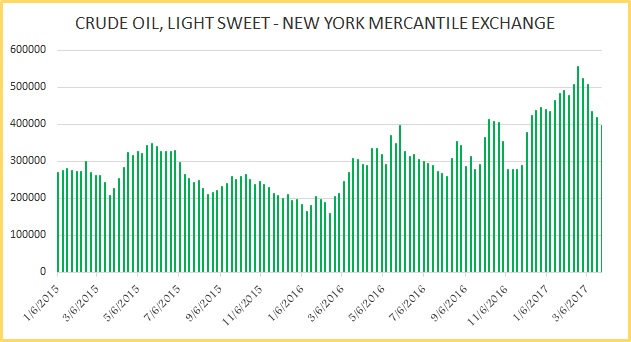

Since the OPEC and 11 non-OPEC participants agreed to cut their production by 1.8 million barrels last November, the commitment of traders reports show that speculators increased their long positions from just 287.9K contracts to a record0high of 556.6K contracts by February this year. That is a more than 93 percent increase in speculative positions in a matter of months. However, as doubts continue to emerge over the ability of the deal to make a severe dent in the supply glut, speculators have reduced their positions to 398.1K contracts as of March 28th. This sharp reduction has been one of the major contributors to oil’s more than 10 percent decline just a few weeks ago. The current position is still just few thousand contracts short of the record high position reached back in 2014 summer (459K contracts) before the oil price crash when the net speculative long positions declined sharply.

WTI is currently trading at $51.1 per barrel and this risk threatens to push prices lower again.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX