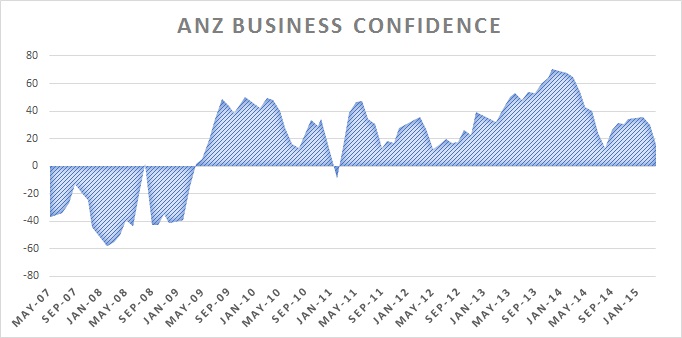

Latest survey by ANZ research revealed that New Zealand economy in spite of its current strength is losing steam and survey correspondents are more concerned of the economic prospects ahead.

- Headline business confidence dropped 15 points in May with only net 16% of the businesses are optimistic about the general economy. Firm's won activity expectations, which is the best proxy for growth fell to two year low at +33.

Most of the correspondents (about net 30%) feel that next move in interest rate will be on the downside, however that seems not enough to encourage business owners.

- Firms' profit expectation dropped from +26 to +20, which is leading to lower investment intentions (+22 to +18) and lower hiring intention (+22 to +17).

- Commercial construction intentions dropped sharply from +45 to +24 in May. RBNZ has taken steps to curb prices in Auckland by introducing higher loan to value ratio.

To add to the concern of Reserve Bank of New Zealand (RBNZ) inflation expectations fell to new record low of 1.6%. Notably New Zealand inflation currently stands at 0.1%. Last time New Zealand had deflation was back in 1999 and even then survey expectation was higher than current.

RBNZ in its latest communications have intended cut rates, which has pushed New Zealand Dollar (Kiwi) sharply lower from around 0.76 to current 0.715 against dollar.

Kiwi even after its recent downfall, still remains elevated, which is making situation tougher for its dairy farmers, who are facing tough times as global dairy prices remain depressed.

Looking at the current scenario, inflation expectations, it can be inferred that single 25 basis points cut would not be sufficient to push inflation towards RBNZ's 2% target. So expect additional cuts and communication to be dovish.

Kiwi is likely to maintain its downside bias, with sellers appearing at rallies. Kiwi is currently trading at 0.714 against dollar.

A cut is very much likely at next meeting scheduled on 11th June 2015.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?