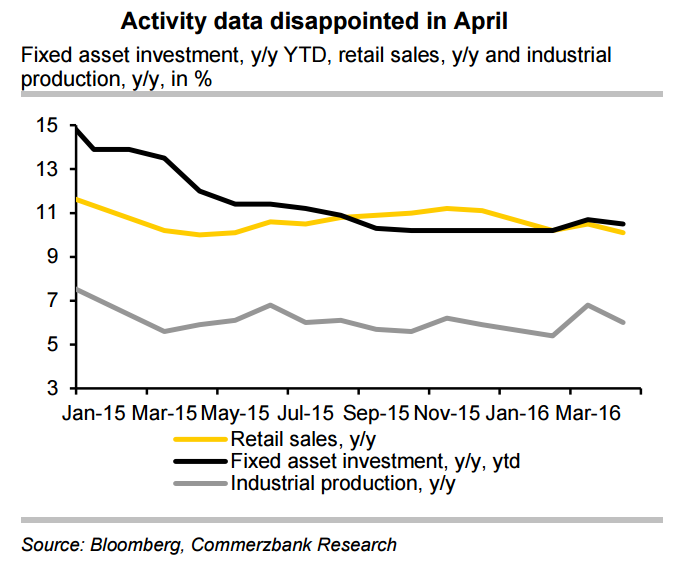

Indicators released on Saturday showed China's investment, factory output and retail sales all grew more slowly than expected in April, raising fears that the data improvement in March was short-lived. Data weakness was seen across the board. Chinese retail sales in April slowed sharply to 10.1% in April, versus March’s 10.5%, also below forecasts of 10.5 per cent. Industrial production dived to 6 per cent from the 6.8 per cent reported in March.

"China's entire release of April data proved that the rapid acceleration seen in March in nearly all aspects — trade, production, investment and credit — was not sustainable," Societe Generale economist Wei Yao said. However, it appeared that the economy was stabilising, she added.

The pullback looks likely to be driven by Beijing's desire to dampen runaway credit growth. President Xi Jinping signalled last week that the government was still committed to reducing debt and reforming the country's bloated industrial sector. China’s new loans came in much lower than expected, at CNY 555.6bn in April, compared with CNY 1.37 trn in the prior month and much weaker than market consensus of CNY 1.3 trn. In the meantime, the aggregate financing was only one-third of the March level, at CNY751.0bn. Moreover, M2 growth slowed sharply to 12.8% y/y in April, down from 13.4% at end-Q1.

Fixed asset investment, which is a proxy for construction and infrastructure spending, grew at 10.5 per cent from the start of the year — somewhat cooler than the 10.5 per cent growth in the first three months of the year. On a positive note, the standout figures were real estate investment — up 7.2 per cent on a year ago — and new construction work for the first four months of the year, which were up more than 21 per cent. However this has been driven by another easing of credit, leading to another massive and worrying wave of debt building up.

"We think the credit and financial data in April remained fairly strong after excluding the impact of those temporary factors. We don’t see the rising easing expectation arising from the weaker than expected April financial and credit data. We think PBoC is likely to remain cautious in terms of credit expansion and liquidity management. The combination of OMO, MLF and PSL will continue dominate PBoC’s policy tools." said OCBC Bank in a report to clients.

Asian markets largely shrugged off data released over the weekend, ended mostly higher on Monday. The Shanghai composite closed up 23.82 points, or 0.84 percent, at 2,850.93, and the Shenzhen composite ended higher by 30.69 points, or 1.72 percent, at 1,815.02. Japan's Nikkei 225 closed up 54.19 points, or 0.33 percent, at 16,466.40, while the Kospi ended near flat at 1,967.91.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate