EUR/USD pared some of its gains after upbeat US PPI data. It hit an intraday low of 1.16487 and is currently trading around 1.16660. Overall trend remains bullish as long as support 1.1590 holds.

With core PPI also showing a notable increase, the July 2025 U.S. Producer Price Index (PPI) rose 0.9% month-over-month—its largest increase since March 2022—signaling widespread inflationary pressures, especially in services and food industries. U.S. Initial Jobless Claims for the week ending August 9, 2025, decreased somewhat to 224,000, simultaneously suggesting a strong job market. These conflicting signals imply that the labor market is still strong even while inflation is rising, therefore providing the Federal Reserve with a difficult obstacle in choosing future monetary policy.

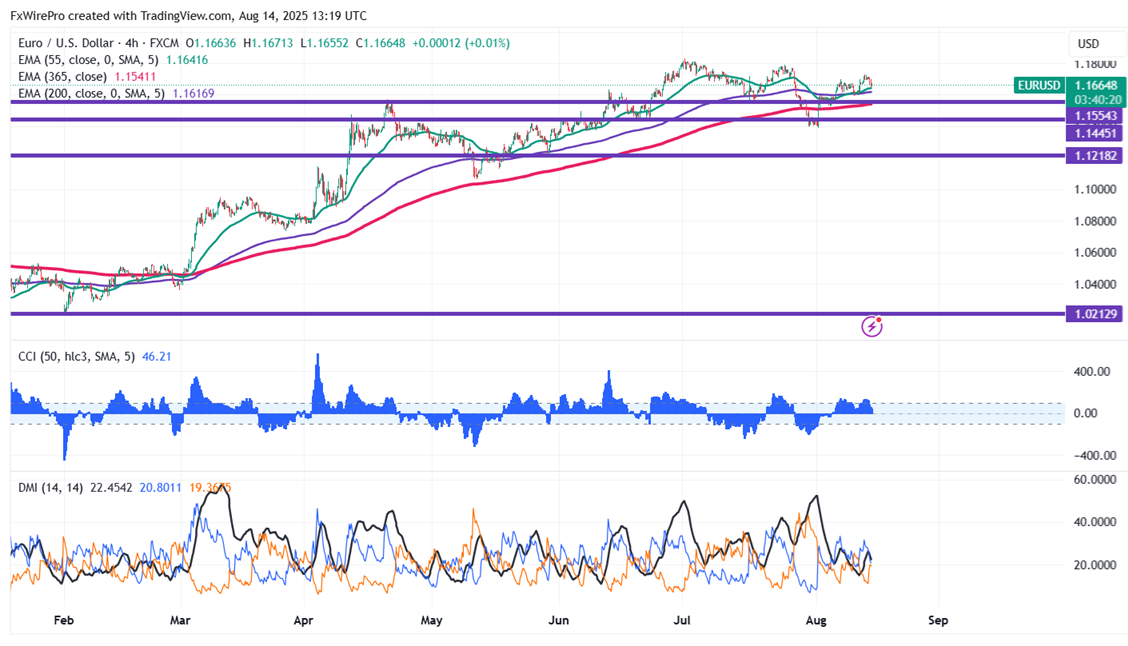

The pair is holding above the 55 EMA, 200 EMA, and 365 EMA in the 4-hour chart. Near-term resistance is seen at 1.1700; a break above this may push the pair to targets of 1.1735/1.1765/1.1800/1.1835/1.1900. On the downside, support is seen at 1.16450; any violation below will drag the pair to 1.1600/1.1545/1.1480/1.1435.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bullish

Average Directional Movement Index (ADX) - Neutral

It is good to buy on dips around 1.1650 with a stop-loss at 1.1600 for a target price of 1.1835.