In the world of cryptocurrency, price represents the equilibrium of supply and demand at any given time. When projects distribute a significant share of their tokens through airdrops, the resulting selling pressure can create long-term challenges. While airdrops encourage adoption, they can also introduce volatility into price dynamics.

Take Notcoin, for example. Its highly anticipated launch last May saw its market capitalization soar into the billions, generating substantial rewards for early adopters. Yet, an initial lower market cap might have provided the project with a more stable trajectory, mitigating pump-and-dump cycles and enabling long-term growth.

Despite its initial success, Notcoin set the stage for a flood of imitators. Many subsequent Telegram mini-apps pivoted from a "play-to-earn" model to a "pay-to-earn" system, shifting incentives away from users toward investors. The question remains: Who absorbs the flood of tokens when recipients start selling?

The Market Response: Diminishing Returns

Investor sentiment plays a crucial role in price sustainability. If buyers expect long-term returns, tokens appreciate in value. But if sell-offs dominate, market caps shrink. While Notcoin’s early investors saw gains of up to 400%, most subsequent Telegram mini-app tokens have yielded diminishing returns.

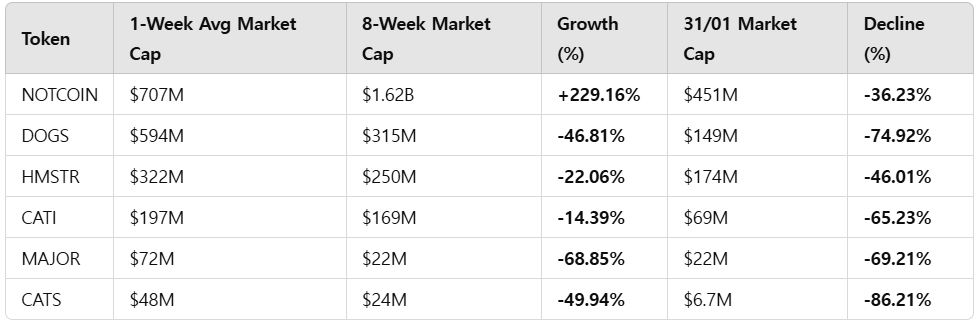

Data illustrates the pattern:

As seen above, each successive token launch has struggled to maintain investor confidence. Prices decline rapidly, creating a cycle of diminishing enthusiasm and falling market caps.

Breaking the Cycle: A Sustainable Approach

To restore faith in TON-based tokens, developers must rethink their launch strategies. Instead of focusing on immediate price spikes, a sustainable model should prioritize:

-

Organic price discovery rather than artificially inflated valuations.

-

Utility-driven growth to ensure long-term engagement.

-

Strategic exchange listings that foster liquidity.

-

Robust trading infrastructure, including DEX aggregators and advanced analytics tools.

The key is to move away from the current CEX -> DROP -> DEATH cycle, which harms traders, projects, and the broader ecosystem. A successful turnaround will depend on a mix of on-chain data transparency, trading incentives, and well-structured tokenomics.

A New Dawn for TON Tokens?

One breakout success story could shift investor sentiment and reignite interest in TON-based projects. Similar transformations have occurred in other ecosystems, including Solana and Ethereum, where one high-profile launch triggered waves of liquidity and participation.

With better infrastructure and smarter launches, TON has the potential to reverse this downward trend. The question is—who will lead the charge?

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary